Do Shipping Indexes Hint at Global Recession?

Q3 is a traditional peak season in the world of shipping, but not this year. Global inflation, weakened consumer demand and excess cargo carrying capacity are pushing the market down.

With a gloomy economic outlook and vague alarms from central banks, it seems recession could be just around the corner.

Are there any indications from the shipping market when global recession is on its way? This is a question not only of interest to the commercial and technical players in the maritime industry, but also to financiers and policy makers.

The last recession triggered by economic factors was the Great Recession from December 2007 to June 2009. Goods loaded worldwide for seaborne trade fell by nearly five percent in 2009 compared to 2008, from about 8.23 billion tons to 7.82, according to UNCTAD’s Handbook of Statistics 2021.

Is a depressed shipping market a contributor to global recession, or does global recession lead the shipping market down? It is a chicken and egg question. But can the Great Recession’s impact to shipping market provide some useful reference to the current situation? Shipping indexes may shed some light.

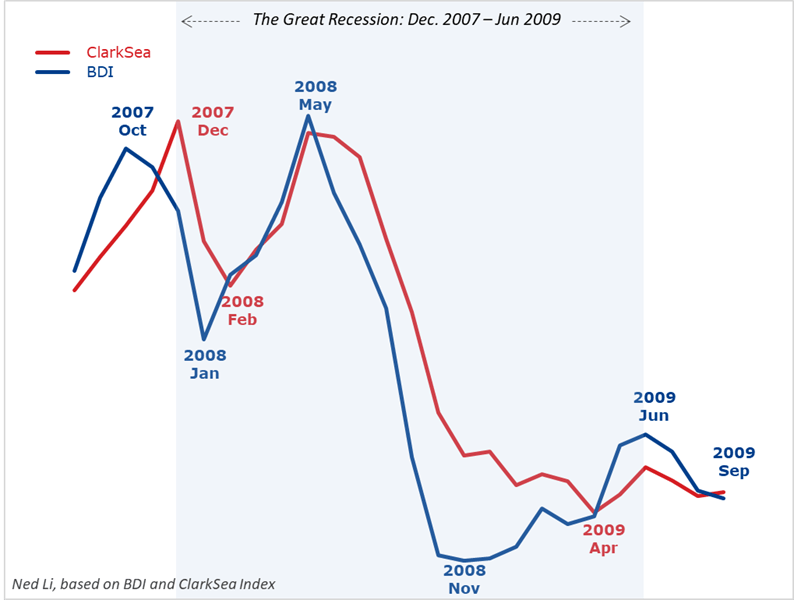

When looking at a combined graph of the Baltic Dry Bulk Index (BDI) and the ClarkSea Index - a weighted average of tanker, bulker, container ship and gas carrier earnings - the BDI started its sharp fall two months before the Great Recession began.

From October 2007 to January 2008, the BDI’s monthly reading dropped from 10,656 to 6,052. Then it made up its lost ground until May 2008, when it surpassed the height set in October 2007. Right away it nose-dived until November 2008. The seven month drop reduced the index by 94 percent. The next seven months reversed the situation, and from November 2008 to June 2009, it bounced back to 3,757.

In short, in the case of the Great Recession, the BDI’s drop started two months ahead. Seven months before the Great Recession ended, the BDI had already touched its lowest point.

Unlike the BDI, the ClarkSea Index seems to be more synchronized with the macroeconomy. Not until December 2007 when the Great Recession was officially defined, the ClarkSea Index responded to BDI’s impacts, as prior to that, the rise of tanker and container markets offset the decline of bulkers. The short term rise of the BDI through May 2008 also helped the ClarkSea Index regain its ground. The turning point came in May 2008, same as that for the BDI, and the ClarkSea Index lost 83 percent in the following 12-month drop. In a nutshell, the ClarkSea Index dropped at the same time when the Great Recession started, and it ended only two months before as the Great Recession did.

Graph 1: Baltic Dry Index (BDI) overlap with the ClarkSea Index, 2007-Aug to 2009-Sep. (For comparison of trends only, not numerical values)

The Great Recession’s impact on the global shipping market supports a hypothesis: shipping indexes can start to drop ahead of a recession, or at least at the same time. Likewise, the resurgence of shipping indexes can begin before a recession has ended.

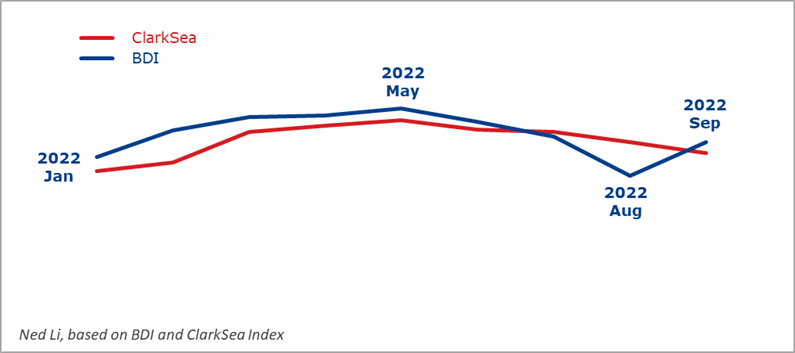

How is the shipping market now? In May 2022, bulker earnings started to drop. Tankers were at a short break in an upward rise. Container freight rates were flat and just about to begin sliding. As of September 2022, only tankers’ earnings are still climbing.

Graph 2: Baltic Dry Index (BDI) overlap with the ClarkSea Index, 2022-Jan to 2022-Sep (For comparison of trends only, not numerical values)

The bulk shipping market’s underperformance will probably continue and will not turn before Christmas, unless there are significant changes - for example, if an easing of COVID restrictions in China pushes up its industrial demand (particularly for iron ore). Demand for oil and gas from the West will help send tanker rates continue soaring. Container shipping is expected to decline in the short term.

During the past months, a black cloud has appeared on the global shipping market’s horizon. The downward trend of shipping indexes brings a sense of foreboding. As to the question, “is a global recession imminent?” Most likely, say signals from these two shipping indexes.

Ned Li is a maritime professional with over 10 years’ experience. He holds a Master of Science degree in Maritime and Transport Management and is currently undertaking a Master of Technology degree in Analytics at the National University of Singapore.

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.