West Africa Container Trade on its Way to Maturity

Shipping analyst Dynamar has released its fifth biennial edition of the West Africa (worldwide) Container Trades, with author Darron Wadey highlighting that although container volumes barely grew between 2013 and 2017, the region is now on its way to maturity. Full container volumes forecast to reach 4.3 million TEU by 2021 as a result of an estimated five percent annual growth rate for container cargoes.

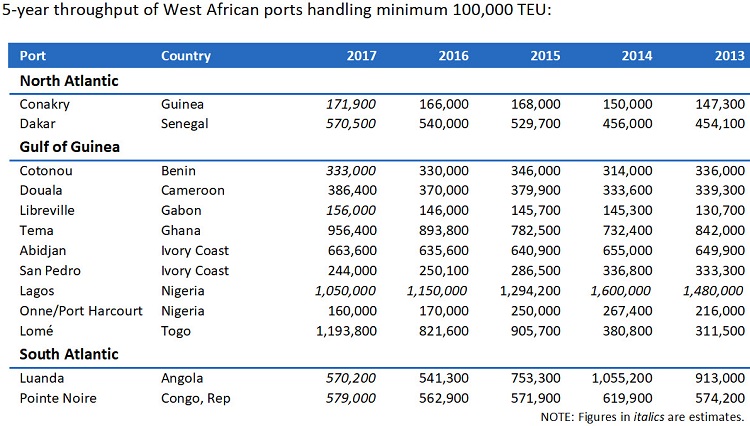

Capacity, carriers, services and sailings, all came down in 2016, says Wadey, but they are now all growing again. Lomé (Togo) is now the major West African container port, surpassing Lagos (Nigeria).

West Africa

West Africa comprises 25 nations, big and small, including five landlocked countries. The total region encompasses around 9,700 kilometers of coastline and a land area of 12.75 million square kilometers. It accommodates over 535 million people, has a trade value of $294 billion and a GDP estimated at $802 billion.

The area is divided in three coastlines: North Atlantic-Mauritania to Liberia, Gulf of Guinea-Ivory Coast to Gabon, and South Atlantic-Congo to Angola. Each area has its own characteristics. For example, Gulf of Guinea and South Atlantic are heavily involved in the oil and gas sectors. This is clearly reflected in their economic performance.

The Gulf of Guinea region makes up for a share of 65 percent of the population, 71 percent of the GDP, 63 percent of trade and 56 percent of container throughput. It also houses the largest ports in terms of throughput, which are located in Togo, Nigeria and Ghana, in that order.

On the way to maturity

“West Africa is clearly moving into the direction of maturation, certainly if compared to East Africa,” says Wadey. “The ships are bigger, there are more carriers and there is a substantial presence of international port operators.”

In 2017, 285 container ships sailed the seven intercontinental trade lanes to West Africa. Deployed by 24 different operators, their average capacity was 3,300 TEU. The biggest ship, a 13,600 TEU vessel, is operated by MSC in a hub and spoke service, connecting Lomé with a large number of regional ports by feeder.

West African terminals and ports have benefited from foreign investment by terminal operators and carriers driving growth, he says. “For that reason they are generally well equipped.” Foreign terminal operators include APM Terminals, Bolloré, China Merchants Ports, DP World, ICTSI, Portek, TIL Group (MSC) and various carriers, such as CMA CGM in Cameroon and Nigeria, Grimaldi in Nigeria, and NileDutch in Angola. Together, these companies are involved in 30 terminals with another five under development.

Crude: promising then and again?

West Africa crude oil production shrank in 2015 and 2016 when the average price of crude oil plummeted. As a consequence, between 2013 and 2017, West African merchandise trade value shrank by one third to $294 billion. In particular Nigeria and Angola suffered, with both countries heavily dependent on the oil and gas industry. “The only region to show absolute growth over the period was the North Atlantic region, generally the poorer cousin. Overall, West African container volumes have grown by 1.4 percent only in 2013-2017 period,” says Wadey.

“However, there is hope for West Africa again and the carriers serving its trades. The price of crude oil is on the rise, bringing investors back. As such, after a massive two year dip, West Africa is poised for strong growth yet again. This should also translate into increased container volumes, forecast to grow by five percent until 2021.”

Bigger, better?

Lomé in Togo has become West Africa’s major port, surpassing Lagos. A key development backing Lomé was the commissioning of Lomé Container Terminal. It handles close to 890,000 TEU annually, close to 75 percent of Lomé’s total throughput of 1.2 million TEU. “The establishment of Lomé Container Terminal is part of a greater trend in West Africa, which sees more and more carriers becoming involved in ports and terminals. After all, carriers must go somewhere using their oversized ships,” says Wadey.

Over the next year, over a dozen West African ports will be able to handle vessels of more than 6,000 TEU, even as large as 10,000 TEU. However, Lagos lags behind, despite being the largest port in the region’s largest economy. It was the highest ranked West African country in 2015 but is now only fifth in terms of liner connectivity. Chronic hinterland congestion threatens its development.

Direct and indirect

There are currently 54 container services connecting with West Africa, down from 71 in 2014.

While direct connections remain the core of the container services to West Africa, feedering or relay via Mediterranean hubs remains resilient. Containers originating from Asia, Europe and the Americas reach their West African destination -and vice-versa- with transhipment at a Mediterranean hub, generally Algeciras or Tangier-Med.

that matters most

Get the latest maritime news delivered to your inbox daily.

Maersk Line and sister Safmarine initiated Algeciras-West Africa transhipment links in the early 2000s, operating eight relevant services in 2004. “Interestingly, despite the emergence of very capable terminals across West Africa, there has been no substantial decrease in indirect traffic via the Med,” says Wadey. “Even today, an estimated 25 percent of all West African container volumes run via a Mediterranean hub.”

The 230-page West Africa Container Trades 2018 report can be ordered for direct download at www.dynamar.com/publications/207 or by contacting Dynamar B.V.