Rystad Energy: Fields with Break-Even Above $60 to be Priced Out

Energy projects that need oil prices above $60 per barrel in order to break even risk being commercial viability going forward, according to Rystad Energy. However, massive investments in exploration and sanctioning are still needed to meet growing global demand.

As the world transitions to a less carbon-intensive future, Rystad Energy forecasts that the global inventory of already discovered oil fields with a breakeven oil price of below $60 Brent (real) is sufficient to meet demand growth and offset declines from maturing fields until around 2027. From that point on, however, additional volumes from not-yet-discovered fields will be needed in order to meet total liquids demand.

Global exploration efforts must, therefore, continue in order to discover those resources in the first place, even under a scenario whereby oil demand peaks in the late 2020s, says Rystad Energy. In addition, operators will need to empty their portfolio of unsanctioned commercial discoveries over the coming years.

“This means that although we need to discover additional resources, only fields with breakeven prices below $60 Brent are likely to be commercial through 2030 and likely towards 2040,” says Audun Martinsen, head of oilfield services research at Rystad Energy. “If the global E&P industry were to fail to discover sufficient resources at such breakeven prices, global demand would need to be satisfied by utilizing otherwise uncommercial fields, or transition more quickly to a different power mix”

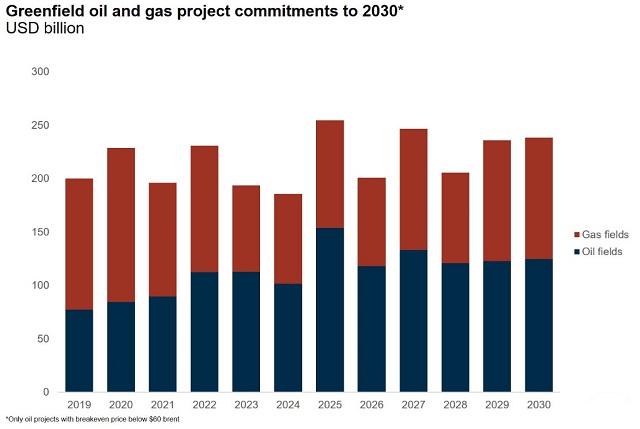

In 2019, oil and gas projects representing around $200 billion of investments were sanctioned. In 2020 Rystad Energy forecasts as much as $225 billion worth of projects will be sanctioned, driven primarily by gas projects, and with $50 billion coming from onshore LNG facilities. Offshore project sanctioning is likely to surpass $100 billion in 2020.

“While most offshore projects sanctioned this year have breakeven prices below $40 per barrel, we foresee breakeven risk for the period 2020 through 2023,” says Martinsen. During this four-year period, offshore projects worth $25 billion, or almost seven percent of the total, have a breakeven price above $60 per barrel.