Poten: Canada's Trans Mountain Pipeline Will Shake Up Pacific Oil Markets

The Canadian government's new Trans Mountain Pipeline (TMX) expansion project is nearly complete, and it will load its first export cargo within months. When it enters service, according to analysts Poten & Partners, it will reshape the Pacific tanker market.

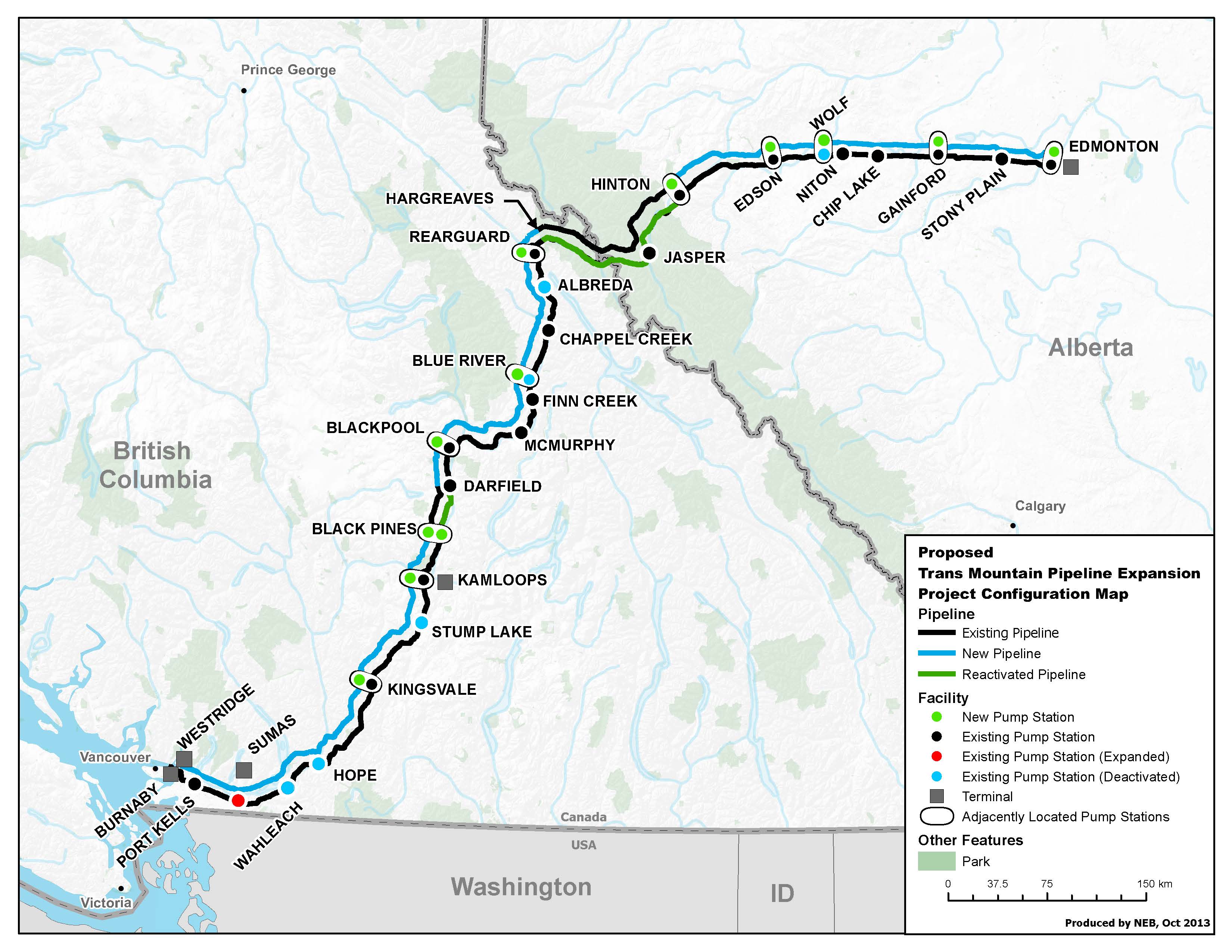

The TMX project was a long time coming. 12 years ago, Kinder Morgan proposed to build a parallel pipeline alongside the existing Trans Mountain line. The new pipe would triple its capacity from 300,000 bpd to nearly 900,000 bpd. The estimated cost as of 2016 was about US$7 billion.

However, the TMX expansion quickly hit roadblocks. British Columbia's provincial government opposed the project, as did many local indigenous communities and environmental groups. To ensure that the pipeline was completed for oil producers in Alberta, the Canadian government bought Trans Mountain from Kinder Morgan in 2018 for US$3.3 billion. Under government management, the price of construction soared to US$9 billion in 2020, then US$15 billion by 2022. The final as-built price came in this year at about US$23 billion.

Courtesy Kinder Morgan / Trans Mountain

Courtesy Kinder Morgan / Trans Mountain

The line's completion opens up new markets for Canadian tar sand oil producers, who have had limited options for overseas sales. Canadian crude exports have been locked into the U.S. market by infrastructure limitations for decades.

Now that it is complete and filling with oil, shipping and energy interests are watching closely to see what TMX's extra 600,000 barrels per day of heavy crude will do to the Pacific market. According to Poten, the new Canadian supply will compete with other sources of foreign oil in the U.S. West Coast market. (The Alaska North Slope crude supply - which is delivered to West Coast refiners by a purpose-built Jones Act fleet - has a firmly established place in the market and is unlikely to be displaced anytime soon, Poten said.) Whatever does not go to the West Coast will be shipped to Asian markets, and the split is not yet certain.

The navigation restrictions at the terminal in Vancouver will have a unique impact, according to Poten. Only Aframaxes can make the transit to and from the loading pier, so cargoes will be limited to about 600,000 barrels per vessel. This means that the terminal will need to load about one tanker every day to keep up with the pipeline's capacity. The demand signal for an extra tanker every day should have a meaningful impact on the global Aframax market, Poten predicted.

"Some of these Aframaxes will shuttle back and forth to the U.S. West Coast, while others will make the trip to the Far East. To better facilitate long-haul exports to Asia, we also expect to see a pickup in reverse lightering to enable the use of VLCCs," the consultancy forecast.