Boxship Orders Surpass Last Year to Reach Third Highest in Past 20 Years

The appetite for new containerships remains high reports BIMCO in its latest market analysis. The trade group highlights that orders after a slight pause in late 2023 are once again roaring in with the volume at its third-highest level since 2008.

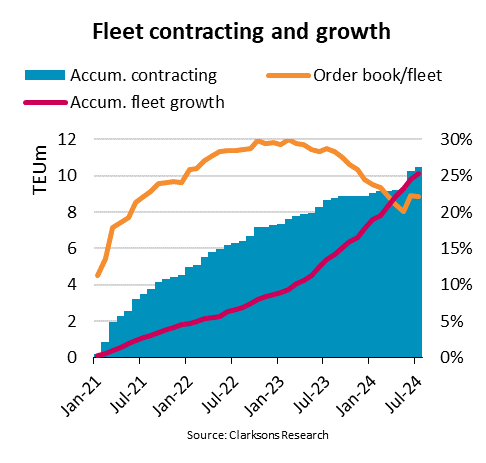

Year-to-date contracting already exceeds the 2023 full-year total points out Niels Rasmussen, Chief Shipping Analyst at BIMCO. They calculate the sector has contracted for 10.47 million TEU of new capacity since the start of 2021. Compared to the size of the fleet at the beginning of 2021, BIMCO says the contracted capacity will add 44 percent new capacity to the industry.

The first portion of the wave began arriving in late 2023 and has accelerated into 2024 with the arrival of the newest ultra-large vessels pushing to new capacities. Yesterday, for example, Orient Overseas Container Line (OOCL) celebrated the naming of the company's twelfth 24,188 TEU newbuilding at a ceremony held at Nantong COSCO KHI Ship Engineering Co. The new vessel, named OOCL Portugal, is the last in the company’s new mega vessel series and was followed today with the naming of Maersk’s fourth 18,000 TEU methanol-enabled boxship, Alette Maersk, in a ceremony hosted with Nike at the Port of Los Angeles.

The 1.59 million TEU capacity contracted so far in 2024 is the third highest since 2008, only exceeded by the first seven months of 2021 and 2022, says Rasmussen. In combination with the 8.86 million TEU contracted between 2021 and 2023, BIMCO highlights the current wave has already surpassed the previous four-year contracting record of 8.31 million TEU ordered between 2004 and 2007, and there are months left to go in 2024.

The pace is not expected to slow. Maersk recently said it was working on finalizing orders and charters for a total of 50 to 60 newbuild dual-fuel vessels equaling 800,000 TEU as part of a fleet renewal program. They expect to take delivery of 160,000 TEU of capacity a year to ensure a steady flow of needed capacity for its network from 2026 to 2030. MSC also recently signed a new partnership agreement with China’s Hengli Heavy Industry leading to speculation of yet more orders from the largest carrier. MSC already has a capacity of over 6 million TEU with a further 1.8 million TEU of capacity on order.

“The fleet is expected to grow at least 12 percent before the end of the decade, equal to an average annual growth rate of 2.4 percent,” says Rasmussen. “Although cargo volume growth might match that pace, we could see pronounced oversupply if fleet growth ends higher and the Red Sea crisis ends, lowering ship demand significantly.”

Carriers have been slow to proceed with recycling due to the surges in demand. Forced to divert ships from the normal Red Sea routes in 2024, the shipping lines are keeping everything possible running to make up for capacity constraints.

“Ship recycling activity has been very low since 2021,” says Rasmussen. BIMCO highlights since 2021, only 150 ships with a combined capacity of only 240,000 TEU have been recycled. “In the coming years, recycling could increase significantly and partly or fully retire the 10 percent of capacity and 20 percent of ships that are currently over 20 years old,” predicts Rasmussen.

that matters most

Get the latest maritime news delivered to your inbox daily.

So far, however, with the slow pace of recycling even with the new rush of new tonnage into the sector, the average age continues to go up. BIMCO says the average age of containerships has increased from 13 years at the beginning of 2021 to 13.9 years today.

With recycling remaining low they note that since 2021 fleet capacity in total is up by a quarter. Alphaliner sets the sector at nearly 7,100 active vessels and 30.5 million TEU in total capacity. They calculate well over 6 million TEU of capacity still on the orderbooks from the largest 100 carriers with BIMCO asking how high will it go.