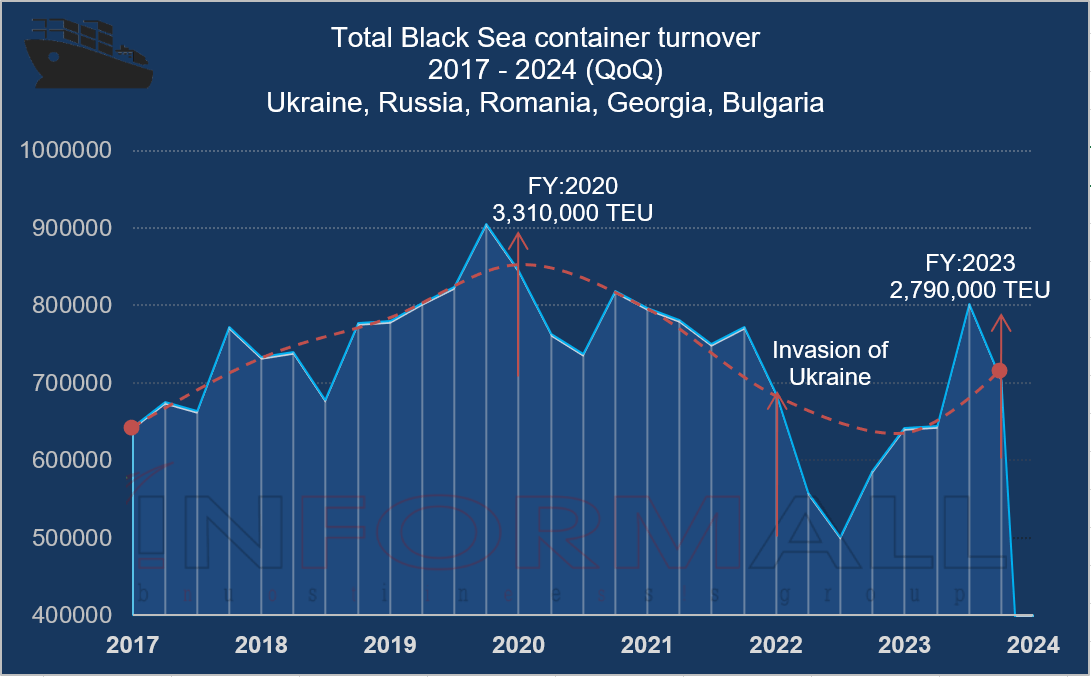

The Black Sea Container Market Has Adapted to Disruption

The Black Sea container market has undergone significant disruption, with Ukraine at the forefront of these changes. Prior to the Russian invasion, Ukraine boasted the highest container volumes among Black Sea countries, with an estimated turnover of over 1 million TEU per year according to local analytical company Informall BG. However, the Russian invasion and subsequent port blockades in 2022-2023 forced Ukraine to halt container shipping to Black Sea ports, redirecting traffic to Romania and Poland. Transit delivery via trucks and rail and river barges became the new norm for the country. In 2024 however, container feeder service will be slowly restored in Ukraine with pioneering shipments occurring in the port of Chornomorsk.

Romania

Between 2022 and 2024, the Port of Constanta in Romania experienced a remarkable surge in container traffic, soaring by over 32%, from 610,000 TEU to 810,000 TEU. The influx of container traffic, largely in transit to Ukraine, presented both opportunities and challenges for Constanta. The rapid arrival of Ukrainian containers in the wake of the 2022 invasion initially strained operations at terminals managed by DP World and SOCEP. However, two years later, the container terminals of Constanta operate seamlessly with no observed bottlenecks. This achievement is attributed to the implementation of standard procedures for handling Ukrainian containers in transit, demonstrating significant progress since 2022.

Georgia

From 2020-22, before the Russian invasion of Ukraine, the container market in Georgia declined. However, since the onset of the war, container turnover at the country’s main port has surged, surpassing 700,000 TEU in 2023, a 50,000 TEU increase from its previous historical record in 2019. Informall BG attributes this growth mainly to containers moving in transit to Russia and Chinese container traffic that is moving via the Middle Corridor to the EU.

Russia

Despite the invasion of Ukraine and subsequent international sanctions, the Russian market experienced a 33% growth between 2022 and 2023, reaching a turnover of 1 million TEU on the Black Sea. Most global shipping lines withdrew from the Russian container market following the invasion and the outbreak of war, with the exception of MSC. However, this vacuum was swiftly filled by Turkish and Asian carriers, as well as the new Russian carriers that emerged from various local logistics companies.

Bulgaria

Situated away from the conflict zone, the Bulgarian market remained stable, exhibiting a positive trend of organic growth at 15% year-over-year and reaching 281,000 TEU in 2023. While in 2022 some Ukrainian cargo flowed through Bulgarian container terminals, by the close of 2023, logistics primarily utilized the ports of Romania and Poland, which offered more favorable transit solutions due to their proximity to the Ukrainian borders.

that matters most

Get the latest maritime news delivered to your inbox daily.

The Black Sea market was thriving for consecutive years; however, the Russian invasion of Ukraine disrupted the region's logistics. Prior to the conflict, Ukraine played a central role in Black Sea trade, driving steady regional growth in container volumes. However, the invasion forced a halt to container shipping, causing a ripple effect across neighboring countries. Despite these challenges, resilience abounds as stakeholders adapt to the new landscape, charting a course towards recovery in the Ukrainian market. Meanwhile, Russia - despite facing sanctions for its aggression - now leads the Black Sea container charts.

Daniil Melnychenko is an analytic consultant for Informall BG.

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.