Retail Sales Continues to Drive Import Volumes at Major US Ports

Strong retail sales as US consumers return to stores with COVID-19 restrictions being relaxed are continuing to drive record import numbers and contribute to the record-setting volumes across America’s largest container ports. According to the National Retail Federation, the volumes are on track to set new records for the year. The retail trade association, however, notes the continued disruptions to the supply chain and the potential to cause challenges as retailers prepare for the busy fall and holiday season sales periods.

“Vaccine rates are increasing, shoppers are back in stores and retail supply chains are working overtime,” NRF Vice President for Supply Chain and Customs Policy Jonathan Gold said. “There’s no shortage of demand from consumers, but there continue to be shortages of labor, equipment and shipping capacity to meet that demand. Supply chain disruptions, port congestion, and rising shipping costs could continue to be challenges through the end of the year.”

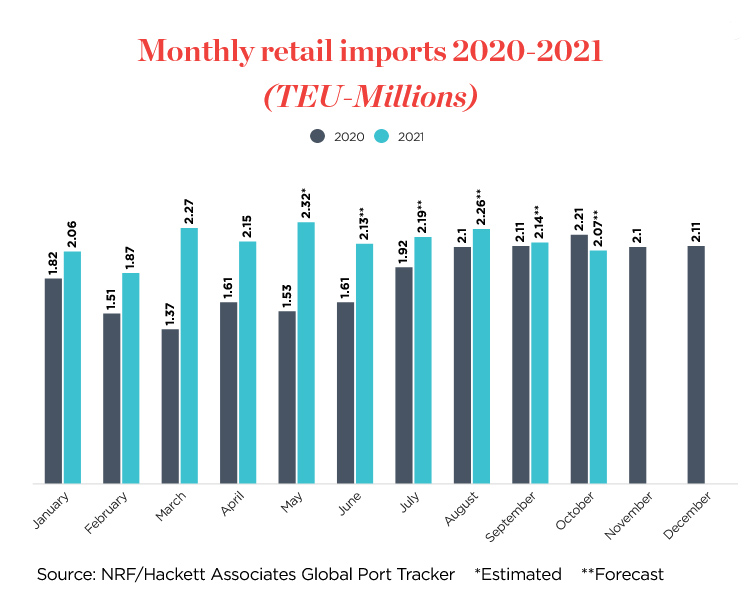

The NRF’s monthly Global Port Tracker, which reports on import volumes at the US’s busiest ports, forecasts that container volumes will be up over 35 percent year-over-year for the first six months of 2021. While year-ago volumes were impacted by the disruptions caused to the supply chain in 2020, the NRF highlights the continuing monthly growth in 2021 as a sign of the strength of retail sales.

March 2021 set a record for the most containers imported during a single month since NRF began tracking imports in 2002. The trend continued with by far the busiest April on record and for May the NRF is forecasting a combined import total of 2.32 million TEU at the US’s largest ports.

The NRF Port Tracker continues to see strong growth into the summer of 2021. Monthly TEU volume could be up over 30 percent in June but with the recovery having begun a year ago, the NRF forecasts a moderation of growth falling to 7.5 percent in August and just 1.7 percent in September. According to the forecast, October 2021 could be the first year-over-year decline since July 2020. The NRF predicts just over two million TEU for a decline of 6.5 percent in October.

“Supply chains are finding it difficult to keep up with demand as shipping capacity struggles,” says Ben Hackett founder of Hackett Associates that produces the monthly forecast. He notes disruptions to shipping schedules due to congestion and a lack of equipment, as well as the impact of COVID-19 on port operations.

that matters most

Get the latest maritime news delivered to your inbox daily.

Fears are continuing to grow over the potential for disruptions and delays due to the current challenges at China’s Yantian port. The container terminal continues to struggle with restrictions and disruptions after an outbreak of COVID-19 in the Chinese province. Maersk today again warned customers that it expects “continued terminal congestion and vessel delays upwards of 14 days in the coming week,” at the Yantian terminal. Other reports indicate that the delays may be spreading to other ports as carriers have begun to divert vessels.

Despite the pandemic and recent challenges to the supply chain, the NRF says that the six-month total for container imports is expected to put 2021 on track to easily beat 2020’s full-year total of 22 million TEU, which was up 1.9 percent over 2019.