How Will the Israel-Iran Conflict Affect the Tanker Market?

In the early hours of Friday, June 13, Israel launched several waves of airstrikes on Iran, targeting command-and-control centers, ballistic-missile bases and air-defense batteries as well as nuclear installations. The attacks also killed several Iranian military commanders and nuclear scientists. Israel indicated that this is only the beginning of a campaign that can last for days or even weeks. The question is, what will happen next? How will Iran respond? Will the United States get involved? What will be the impact on the oil and tanker markets? We don’t have any answers, but we can discuss a few scenarios and look back at what happened during previous conflicts in the region.

In an immediate response, Iran launched a drone attack on Israel, but that was largely ineffective. Most of them were shot down and no significant damage was reported. Since then, Iran has started firing ballistic missiles towards Israel. Analysts do expect a forceful response from Tehran, not least because the regime has to save face with their domestic population. However, their options are limited. The Israeli attacks have reduced Iran’s ability to reach Israel and inflict significant damage. The capabilities of Iran’s proxies in the region, Hamas, Hezbollah, the militias in Iraq and the Houthi’s have been diminished and the Assad regime in Syria has been toppled.

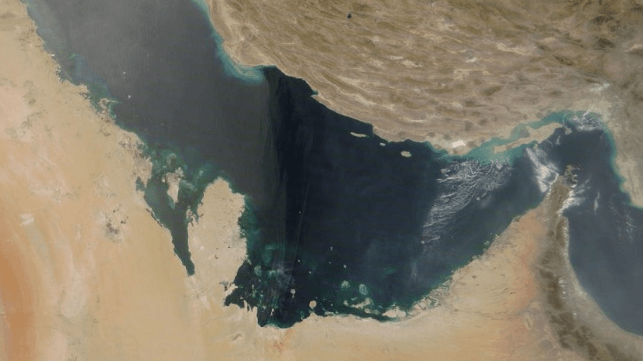

Iran does have options to retaliate. They could try to close the Strait of Hormuz or disrupt shipping at this chokepoint through which more than 20% of global oil supplies are shipped. They could attack oil installations in neighboring countries or target U.S. military bases in the region.

However, all of these potential actions carry significant risks. Closing the Strait of Hormuz or attacking energy infrastructure in the region will spike energy prices, turn all their neighbors into adversaries and more likely than not draw the U.S. military, which has a large presence in the region, into the conflict. Closing the Straits of Hormuz may also hamper Iran’s own export capabilities and give the Israelis and/or Americans an incentive to attack their energy infrastructure (refineries, pipelines, export terminals, etc.). Losing the income from energy exports would quickly exhaust Iran’s resources and ability to fight back.

In the immediate aftermath of the Israeli attacks, both oil prices and tanker rates moved up. This was to be expected and is a normal reaction to a spike in geopolitical tensions and an increased risk of significant disruptions to global energy supplies. Where oil prices will go over the next few days and weeks, will depend on whether there will be actual disruptions to oil supply. Overall, the global oil markets are well supplied, and inventories are at healthy levels worldwide.

Iranian supplies are increasingly at risk, however. Even before Israel’s attack, most oil market forecasts already assumed a decline in Iranian production over the coming months, leading to a decrease in Iranian exports of around 400-500 kb/d. This figure will likely increase if the conflict escalates. Chinese independent refiners, which buy almost all Iran’s oil, will need to look for alternative sources of crude, and they could try to buy more discounted crude from Russia or look for alternative barrels in the Middle East.

Tanker rates also rose after the attacks, in particular for VLCCs, the main vessel class for Arabian Gulf exports. Similar to the reaction of oil prices, this is a normal development under the circumstances. Rates for the benchmark Arabian Gulf (AG)-East VLCC route increased from WS43 to W55. However, while the increase is significant in percentage terms, the tanker market remains in the summer doldrums. Further rate increases are possible over the next few days, depending on how the conflict evolves, but it is also possible that the market weakens again after the weekend. In previous conflicts, charterers sometimes panicked and, in an attempt to access additional cargoes, fixing activity would rise dramatically. At the same time, shipowners would become increasingly reluctant to enter high risk areas such as the Arabian Gulf. This combination of factors would push tanker rates much higher very quickly. We are not in this scenario at the moment. According to our tanker brokers, fixing activity has not surged so far and most owners are still willing to bring their tankers into the AG. However, this can change quickly. Stay tuned.

Erik Broekhuizen is the manager of marine research and consulting at Poten & Partners.

This update appears courtesy of Poten & Partners, and it may be found in its original form here.

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.