Global Container Ship Trade Suffers Capacity Drop

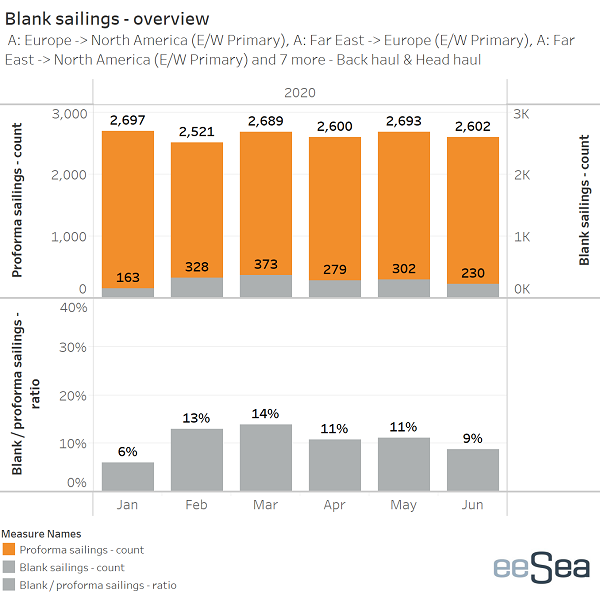

Eleven percent (302 of 2,693) of container ship sailings have been canceled in May on all the main line trades, according to maritime intelligence company eeSea.

In the first six months of 2020, 1,675 sailings have been canceled, representing 13 percent for 2M, 17 percent for Ocean Alliance and 17 percent for THE Alliance, while only eight percent of non-alliance sailings have been canceled.

Simon Sundboell, CEO and Founder of eeSea, said: “Understandably, ‘blank sailings’ are the talk of the town among container shipping and supply chain professionals these days. But to truly understand the impact, you need to look beyond the daily trickle of carrier advisories and the number of canceled sailings. Instead, you need to look at the reduction of container shipping capacity and the pattern that is forming for the weeks and months ahead.”

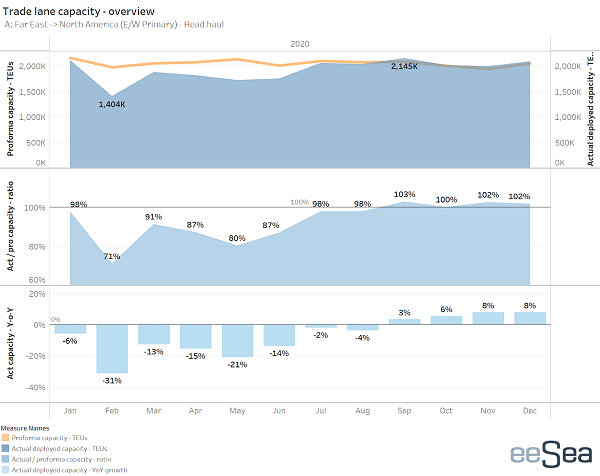

This capacity is also reducing, says Sundboell. On, for example, the Far East - North America eastbound head haul (including Suez services), the actual deployed vs proforma capacity ratio, after blanks and suspensions, for May is 80 percent - almost as big a reduction as the February ratio of 71 percent. YoY (year-on-year), including discontinued services, the reduction in May is 21 percent.

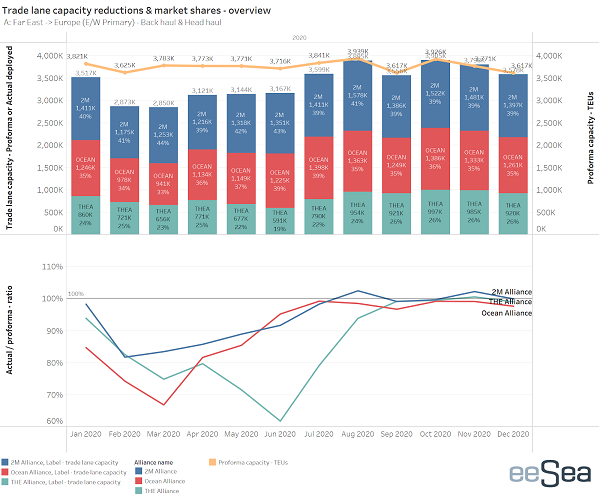

The other benchmark head haul trade, Far East to Europe westbound, shows similar capacity reductions. Sundboell says that in June Ocean Alliance will overtake 2M as the largest alliance on the trade lane for the first time since October 2019.

As of April 22, the status on the major trade routes is as follows:

FAR EAST - EUROPE HEAD HAUL (Med + Northern Europe)

Far East to Europe westbound will see 14 percent of sailings, or 18 of 127 sailings, canceled in April. This corresponds to a capacity reduction of 12 percent. This is down from 36 percent canceled sailings in February, and 21 percent in March. Currently, 19 percent of sailings in May are already announced as canceled, and 12 percent in June.

THE Alliance has canceled 22 percent of their April FEA-EUR sailings, and already canceled 32 percent in May and 34 percent in June. 2M and Ocean Alliance are at respectively 12 percent and 10 percent in April, and 16 percent and 12 percent in May. Ocean Alliance canceled 40 percent and 30 percent of FEA-EUR sailings in February and March.

Over the six-month period from January to June, the alliances have canceled 18 percent of FEA-EUR sailings, with Ocean Alliance at 17 percent, THE Alliance at 23 percent and 2M at 14 percent.

For the first half of 2020, the current announced reductions amount to a 17 percent YoY drop in deployed capacity, from 11.2 million in 2019 H1 to 9.5 million TEU in 2020 H1.

FAR EAST - NORTH AMERICA HEAD HAUL (East + West coasts, inc. Suez service)

Transpacific eastbound will see 234 of 249 sailings, or 14 percent, canceled in April. This corresponds to a reduction in capacity of 13 percent. This is still down from the 28 percent canceled sailings in February. March saw nine percent canceled, and currently 20 percent of sailings in May are announced canceled, and 15 percent in June.

THE Alliance has canceled 19 percent of sailings on Transpacific eastbound in April. 2M and Ocean Alliance are at 16 percent and 11 percent, respectively. Over the six-month period from January to June, the 2M, Ocean and THE alliances have canceled 18 percent, 12 percent and 19 percent of sailings respectively.

that matters most

Get the latest maritime news delivered to your inbox daily.

For the first half of 2020, the current announced reductions amount to a 16.5 percent YoY drop in deployed capacity, from 12.4 million in 2019 H1 to 10.7 million TEU in 2020 H1.