EIA: Sulfur Cap Effects Will Diminish Over Time

The U.S. Energy Information Administration (EIA) has predicted that the effects of the sulfur cap on crude oil and petroleum product markets will be most acute in 2020 and will diminish over time.

Set to go into effect January 1, 2020, the new IMO regulations limit the sulfur content in marine fuels used by ocean-going vessels to 0.5 percent by weight, a reduction from the previous limit of 3.5 percent. The change in fuel specification is expected to put upward pressure on diesel margins and modest upward pressure on crude oil prices in late 2019 and early 2020.

Removing sulfur from residual oils or upgrading them to more valuable lighter products such as diesel and gasoline can be an expensive and capital-intensive process. Refineries have two options: they can either invest in more downstream units to upgrade residual oils into more valuable products or they can process lighter and sweeter crude oils, which produce less residual oils.

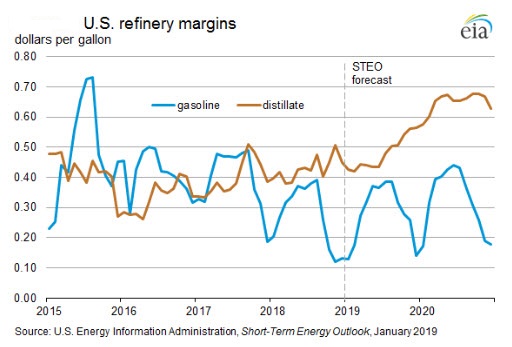

EIA expects that once implemented, the new IMO fuel specification will widen discounts between light-sweet crude oil and heavy-sour crude oil grades, while also widening the price spreads between high- and low-sulfur petroleum products. Because of an increased premium on low-sulfur fuels, EIA expects diesel fuel refining margins will increase from an average of 43 cents per gallon (gal) in 2018 to 48 cents/gal in 2019 and to 65 cents/gal in 2020. Motor gasoline margins averaged 28 cents/gal in 2018 and will increase slightly to an average of 32 cents/gal by 2020.

As they maximize production of diesel fuel, refineries will increase distillate fuel refinery yields from an average of 29.5 percent in 2018 to 29.9 percent in 2019 to 31.5 percent in 2020, while motor gasoline yields will fall from an average of 46.9 percent in 2018 to averages of 46.5 percent in 2019 and 45.6 percent in 2020. Residual fuel yields will decrease from an average of 2.4 percent in 2018 to an average of 2.2 percent in 2020.

To meet increased demand for low-sulfur fuels, EIA expects that gross inputs into refineries will increase from an average of 17.3 million barrels per day (b/d) in 2018 to a record level of 17.9 million b/d (up 3.6%) on average in 2020. This increase in gross inputs will result in refinery utilization increasing from an average of 92 percent in 2019 to an average of 96 percent in 2020.

U.S. Gulf Coast refineries have significant capacity to process high-sulfur crude and unfinished oils relative to the rest of the world. As a result, the Gulf Coast will continue to import large quantities of heavy-sour crude oils. U.S. distillate fuel net exports are forecast to increase to 1.8 million b/d in 2020, almost 0.6 million b/d (57.4 percent) higher than in 2018, as U.S. refiners export increasing amounts of IMO-compliant fuel to global bunkering hubs.

Because two of the largest bunkering ports are outside of the Organization for Economic Cooperation and Development (OECD), marine distillate use in non-OECD countries will likely increase through 2020. Likewise, high-sulfur residual fuel oil currently used for bunkering fuel will likely decline.

Also, EIA does not expect a significant switch to LNG in 2020 as a result of the regulation because of a lack of sufficient infrastructure to support LNG as a shipping fuel.

EIA does not anticipate the regulations will have a significant effect on total global liquid fuels consumption in 2020. The switch from highly energy-dense residual fuel to marine distillate will likely result in an increase in total liquid fuels consumption of no more than 0.1 million b/d (0.1 percent) because using less energy-dense fuel will require some increase in volume to serve an equivalent level of shipping traffic.

Based on the most recent data available, U.S. consumption of bunker fuel was about 0.3 million b/d, and EIA expects the overall effect on product supplied to be very small. In the bunker market, a modest shift from residual fuel use to distillate is likely. However, uncertainty exists regarding the IMO-compliant fuel specification and, in turn, what its supply chain will look like. As a result, the distribution of individual fuels is uncertain.

Source: EIA