Cruise Executives Optimistic as They Plot Metered Growth for Industry

The cruise industry continues to express its strong enthusiasm and strong outlook for the business. However, like all parts of the shipping industry, there is a range of challenges emerging with much of the conversation during the industry’s largest annual trade event, Seatrade Cruise Global 2024 in Miami Beach this week dominated by the issues of the environment and sustainability.

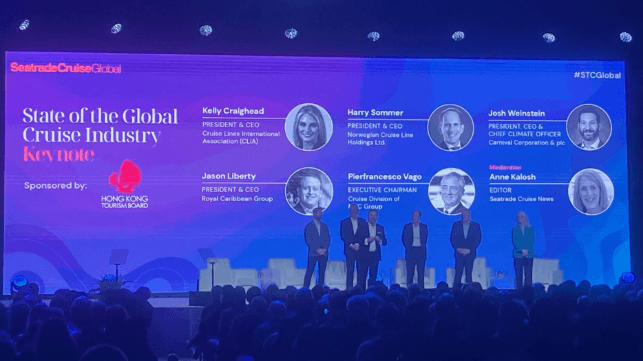

“The concept of pent-up demand is gone,” declares Josh Weinstein, CEO and President of Carnival Corporation describing the current business environment. He points out that it is three years since the industry resumed after the COVID-19 pandemic. He calls the current demand profile “unprecedented,” while saying 2025 bookings and demand are better showing that the industry has resumed its growth.

Growth

Industry trade group Cruise Lines International Association (CLIA) is forecasting that member cruise lines will experience a 7.5 percent passenger increase this year after a strong year in 2023 when at 31.7 million passengers they surpassed the pre-pandemic peak by two million passengers. CLIA is forecasting a further 6.7 percent increase in passengers in 2025, which is especially significant as the industry is currently capacity constrained with a lull in ship construction before the next wave of new large ships just being ordered past the pandemic begins to emerge.

Supporting the excitement for the cruise industry growth is data from a new study by CLIA citing a high intent to cruise again (82 percent) among former passengers. They are also reporting that the data shows the highest-ever intent to cruise among the vital “new to cruise” segment.

Environmental Concerns

Like other segments of commercial shipping, the cruise industry is focusing on the challenges of sustainability and the road to net zero. Cruise executives like their colleagues in segments such as containers, tankers, and dry bulk, express the uncertainty of what the future fuel will be and the supply and affordability of alternative fuels.

Under the lead of CLIA, the industry is calling on governments for their support and to drive efforts to develop alternative fuel sources. Jason Liberty, President and CEO of Royal Caribbean Group and also the current chairman of CLIA cites the opportunities also for expanding shore power. They note that globally only two percent of ports currently have shore power connections available.

Harry Sommer, President and CEL of Norwegian Cruise Line Holdings highlights the cruise industry faces ten different regulatory regimes that often overlap and sometimes conflict, a view shared by Pierfrancesco Vago, Executive Chairman of MSC Cruises, speaking in his role as chairman of CLIA Europe. All of the executives agree that a partnership is needed between the industry and governments, with Vago reporting they look to elevate the issues to the International Maritime Organization and work with IMO calling for global harmonization of the regulatory regimes.

“Regulators should be focusing on the goal, and not the steps,” says Sommer. “We are wasting resources with the focus on the 10 regulatory environments, where we should be focused on achieving decarbonization.”

Transforming Approach

The industry points to multiple steps it is taking to improve its sustainability. Josh Weinstein of Carnival Corporation acknowledges that distance and speed can be used to impact cruise ship emissions, but points out that the industry’s focus requires broader itineraries. He points out that sustainability is broader also for the businesses and regions the industry visits.

While the markets have reopened there is also an agreement that it is a different approach post-pandemic. China was the last major segment to resume operations but both Royal Caribbean and MSC Cruises point to a more metered approach to the market. They point to the opening of China to direct marketing versus the previous approach which centered on charters marketing the cruises and passengers who are looking for experiences beyond shopping that drove the early Chinese interest in cruising. Despite that, both Carnival Corporation and Norwegian Cruise Line Holdings said they are taking a “wait and see” approach to the restored Chinese market.

Cruising has transformed its marketing as the executives believe selling “experiences” appeals to travelers and gives cruising its advantage in travel marketing. They believe that the value gap remains as cruising is less costly versus similar land-based vacations, but they also believe there is an experience gap that cruising offers in the variety of destinations and people-to-people and personal experience opportunities tailored to the individual traveler.

Travelers' experiences which are shared on social media have become the strongest selling tool for the cruise industry. Harry Sommer of NCLH refers to the “flywheel of people cruising,” saying that the new to cruise segment is coming to the ships through referrals and maybe a little envy seeing friends having such unique experiences while on vacation.

New Ships

The industry however also looks to a more metered approach to growth going forward. While major brands including Norwegian Cruise Line Holdings, Carnival Corporation, MSC Cruises, and Royal Caribbean International, have each placed orders, they point out that with a limited number of shipyards capable of building large cruise ships, there will be a slower introduction versus pre-pandemic. At the same time, Josh Weinstein of Carnival proudly highlights despite being the largest cruise corporation they have the smallest orderbook with a planned pace of one to two new ships per year going forward.

While the industry looks to a more metered pace of new ships, they also admit that new ships continue to drive excitement and generate the strongest pricing and bookings. They also however note that new ships aid the whole industry and they believe are contributing to the strong interest demonstrated in CLIA’s study. They conclude by saying that it is the best of times for the cruise industry with a strong outlook for the future.