$3.5B of O.K. Lim Family's Assets Frozen in Fraud Lawsuit

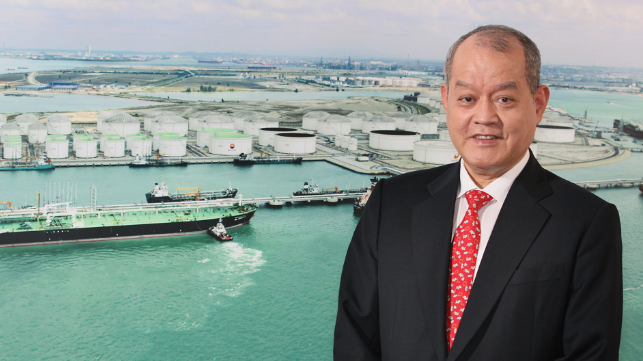

A court in Singapore has approved a prosecutor's request to freeze the assets of Lim Oon Kuin (also known as O.K. Lim) and his family as litigation continues over the alleged financial fraud at Lim's businesses. The freeze covers an astonishing $3.5 billion in holdings, and it opens a path to further loss recovery for the creditors of oil trading house Hin Leong Trading, the linchpin in Lim's former empire.

Lim's business empire collapsed last year amidst allegations of fraud, and he has been charged with abetment of forgery. Singaporean prosecutors contend that he directed an executive at Hin Leong to falsify documents in order to obtain tens of millions of dollars in trade financing, then failed to repay the money. In May, prosecutors added 23 more charges against OK Lim in connection with allegedly fraudulent transactions with China Aviation Oil (Singapore), bringing the total to 25 counts.

According to PricewaterhouseCoopers, the court-appointed manager for Hin Leong Trading, the Lim family manipulated the firm's books through irregular accounting entries in order to hide trading losses. The methods allegedly included overstating inventory and accumulating more debt by deceiving lenders, the same acts alleged in Singaporean prosecutors' criminal suit. The misstatements made Hin Leong look profitable, and the company racked up about $3.5 billion in debt that it ultimately could not repay.

With creditors in control of Hin Leong and two related firms, Ocean Tankers and Xihe Capital, liquidation of Lim's businesses is proceeding quickly. Despite the rapid-pace sales, however, creditors of Hin Leong have been able to recover less than a tenth of the total $3.5 billion owed.

The new freeze seeks to preserve the Lim family's personal assets for possible recovery, including the holdings of Lim's son Lim Chee Meng and daughter Lim Huey Ching. The order requires the family to maintain holdings valued at $3.5 billion or more in Singapore. They may still trade or sell their assets - and even remove them from the country - so long as the total does not fall below that threshold, according to the court.