CNBC: Carnival is Exploring Sale of Seabourn to Saudi Investors

Carnival Corporation, which is the world’s largest cruise company, is reportedly in negotiations to sell one of its luxury brands to Saudi investors. CNBC first reported the news this afternoon saying that preliminary negotiations are ongoing exploring the potential sale of Seabourn Cruise Line to the Saudi sovereign wealth fund, the Public Investment Fund, which has been an investor in Carnival Corporation since 2020.

CNBC reports that “people familiar with the situation” told them about the negotiations. Carnival refused to comment on rumors or speculation to CNBC, while the Saudi fund did not reply to their inquires.

The Public Investment Fund launched the Cruise Saudi initiative at the beginning of 2021 as part of the efforts to expand Saudi Arabia’s tourism industry, leveraging its UNESCO sites and natural resources, by establishing and developing the cruise industry in Saudi Arabia. Part of the goal is to attract more tourists and international cruise ships to Saudi Arabia. The government mapped out a plan running from 2021 to 2025 to increase investments in non-oil industry projects as part of an overall effort to diversify revenue sources away from oil.

Saudi Arabia’s sovereign-wealth fund acquired its first investment in Carnival Corporation in the spring of 2020 buying over 43.5 million shares of Carnival stock, amounting to approximately 8.2 percent of the shares outstanding, according to a filing with the United States Securities and Exchange Commission. In its most recent filing, the fund reports it has increased the investment in Carnival to 50.8 million shares as well as $40 million in Carnival’s notes.

Speculation is that Carnival Corp. is exploring the sale of one of its brands as a means of raising additional capital. In March, during the corporation’s last update to investors, Arnold Donald, President and CEO, highlighted their success since the onset of the pandemic at completing a continuous stream of capital raising. He noted that it had exceeded $29 billion while also refinancing more than $9 billion of debt, improving interest rates, amending over 100 different lender agreements, and successfully addressing the corporation’s maturity tower out through 2024. He noted that they maintained a consistent liquidity position exceeding $7 billion. Just last week, Carnival Corp. also announced that it had priced an additional private offering of $1 billion of senior unsecured notes due in 2030 to refinance notes due in 2023.

that matters most

Get the latest maritime news delivered to your inbox daily.

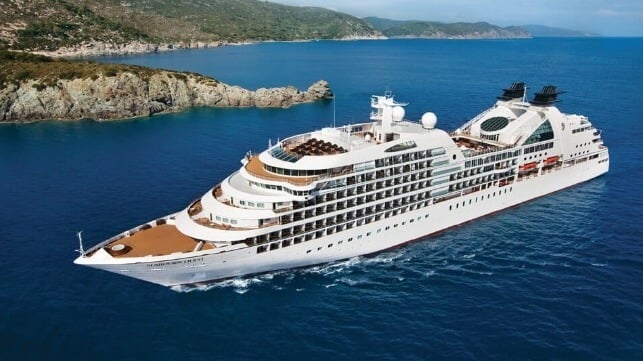

It is not known if Carnival is looking to establish a joint venture with Cruise Saudi as an investor in Seabourn or if they were exploring the sale of the brand. Seabourn was started in 1988, by Norwegian industrialist Atle Brynstad and veteran cruise line executive Warren Titus, who had previously launched Royal Viking Line another well-respected luxury brand. They ordered three 10,000 gross ton all-suite cruise ships each accommodating 200 passengers to be built in Germany. The cruise line completed two of the three ships before running low on capital.

Carnival Corporation made an initial investment in Seabourn in 1991 and again in 1996 when they acquired 50 percent of the company. They acquired the remainder of Seabourn in 2001 and after rumors that they were considering selling the niche brand announced plans to expand the cruise line starting in 2006. The original ships were replaced by five larger, 600-passenger suite cruise ships, and starting this year Seabourn is scheduled to launch the first of two luxury cruise ships designed for expedition cruising. Seabourn remains a nice brand within the Carnival operation focused on the ultra-luxury segment of the market.