No Respite for Shipping from Global Economy

Limited economic growth potential and the slow pace of recovery of the global economy is only easing the pain in the global shipping industry to some degree. While the industry continues to suffer from oversupply in the freight market, the International Monetary Fund (IMF) now projects the demand side to be even less accommodative than previously assessed.

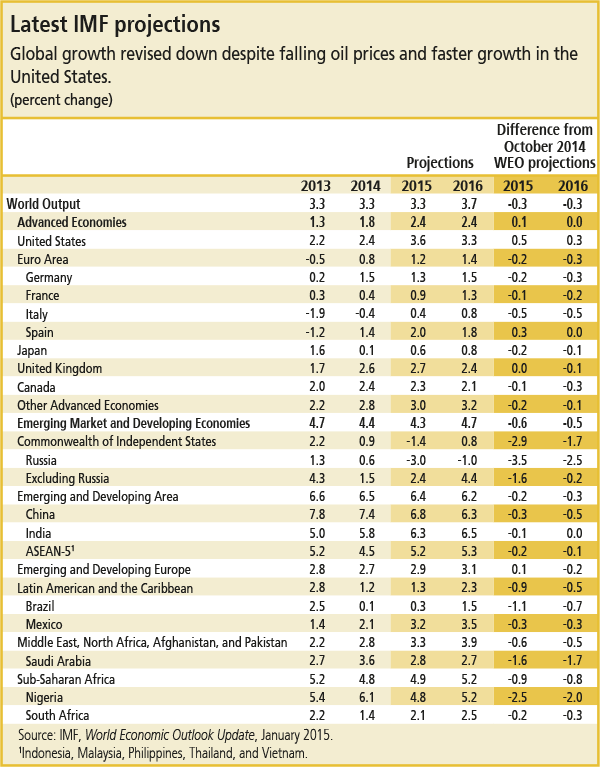

In the recently released January World Economic Outlook update, the IMF has adjusted projected growth for both 2015 and 2016 by -0.3%. The fund now expects global GDP to grow to by 3.5% in 2015 and 3.7% in 2016, up from 3.3% in the past two years.

Chief Shipping Analyst at BIMCO, Peter Sand, says: “The downward adjustment was expected, but it hits hard nonetheless. The global shipping industry needs much stronger support from the demand side to gradually improve the situation of too many ships chasing too few cargoes.

“However, we cannot shy away from the fact that too many ships is primarily an internal problem that we have to solve. Amongst the elements that are effective in working to improve the fundamental balance are: slow steaming, the recycling of commercially sub-standard ships and adding capacity by using the second-hand markets”.

The IMF has adjusted the US significantly upwards and the US thus contributes extensively to the heightened economic activity in the Advanced Economies. The Euro Area, too, is contributing to higher growth in the Advanced Economies, but has been revised downward by 0.2% to 1.2% in 2015.

In the Developing and Emerging Economies, China and Russia are grabbing the headlines. As Chinese policy-makers continue to reduce the risks from the housing market and shadow-banking sector, slower growth follows in the wake. The focus on the transition from an investment-driven economic growth to a consumption-driven one has also lowered GDP growth going forward. However, as the world’s second-largest economy is still growing by 6.8% in 2015, down from 7.4% in 2014, the high growth level remains a key support for global shipping demand.

Despite being a minor economy in itself, the geopolitical uncertainty originating from Russia affects shipping negatively. Dry bulk exports, imports of containerized goods, as well as the trade in oil products, are experiencing a lot of uncertainty as sanctions bite and trading conditions suffer. The IMF expects that the Russian economy will shrink by 3.0% in 2015.

“The lower oil price is good for shipping as well as for the oil importing countries as it bring costs down and boost demand, whereas the lower Chinese growth rate affects the entire intra-Asian trades negatively.

“Lower Chinese growth also means lower commodity prices as we have seen, particularly in the last year, for dry bulk commodities. While this may limit revenues in the exporting nations, lower commodity prices in general affect shipping demand positively“, adds Peter Sand.

that matters most

Get the latest maritime news delivered to your inbox daily.

Source: https://www.bimco.org