FSRUs Gaining Global Popularity

Floating regasification is increasingly being used to meet natural gas demand in smaller markets, or as a temporary solution until onshore regasification facilities are built. Of four countries planning to begin importing LNG in 2015, three of them—Pakistan, Jordan, and Egypt—have chosen to do so using floating regasification rather than building full-scale onshore regasification facilities.

Floating regasification involves the use of a specialized vessel called a floating storage and regasification unit (FSRU), which is capable of transporting, storing and regasifying LNG onboard. Floating regasification also requires either an offshore terminal, which typically includes a buoy and connecting undersea pipelines to transport regasified LNG to shore, or an onshore dockside receiving terminal. An FSRU can be purpose-built or be converted from a conventional LNG vessel.

Floating regasification involves the use of a specialized vessel called a floating storage and regasification unit (FSRU), which is capable of transporting, storing and regasifying LNG onboard. Floating regasification also requires either an offshore terminal, which typically includes a buoy and connecting undersea pipelines to transport regasified LNG to shore, or an onshore dockside receiving terminal. An FSRU can be purpose-built or be converted from a conventional LNG vessel.

Floating regasification offers a flexible, cost-effective solution for smaller or seasonal markets, and can be developed in less time than an onshore facility of comparable size. It can also serve as a temporary solution while permanent onshore facilities are constructed, and an FSRU can be redeployed elsewhere once construction is completed. There are currently 16 FSRUs functioning as both transportation and regasification vessels and five permanently moored regasification units that have been converted into FSRUs from conventional LNG vessels.

Global Spread

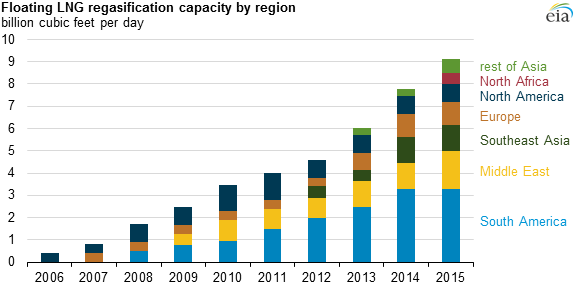

The use of floating regasification has grown rapidly in recent years, particularly in emerging markets facing short-term supply shortages. Floating regasification was first deployed in the U.S. Gulf of Mexico in 2005 and, since its deployment, it has been used in nine other countries: Argentina, Brazil, China, Indonesia, Israel, Italy, Kuwait, Lithuania, and the United Arab Emirates.

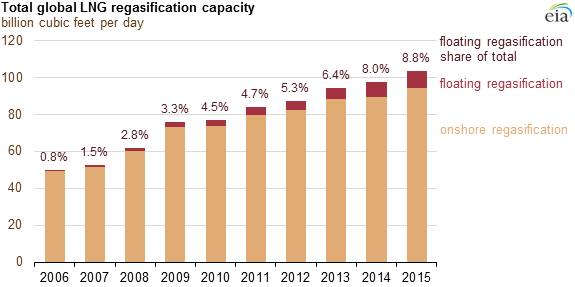

Floating regasification capacity totaled 7.8 billion cubic feet per day (Bcf/d) at the end of 2014, representing 8 percent of the global installed regasification capacity, according to data from the International Gas Union. The three floating terminals that are scheduled to come online in 2015 will add 1.4 Bcf/d of new capacity.

Pakistan received its first LNG import cargo on March 27, 2015 after completing the development of receiving infrastructure for an offshore regasification terminal (0.3 Bcf/d capacity) located near Port Qasim, Karachi, which will be served by an FSRU.

Egypt, a traditional natural gas exporter, has formerly supplied natural gas to international buyers by both pipeline and through two LNG export terminals. Faced with domestic supply shortages because of rapid growth in natural gas consumption for power generation, Egypt suspended exports and scheduled all natural gas production for domestic consumption. Egypt began building infrastructure for an offshore regasification terminal in 2012, and recently contracted an FSRU. The terminal (0.5 Bcf/d capacity) received its first LNG cargo in early April.

Jordan lacks domestic energy reserves and has struggled to meet rapidly growing domestic natural gas demand after Egypt suspended pipeline exports to the country. Floating regasification became the only short-term option for natural gas supply, and Jordan has made significant progress in building regasification infrastructure since 2013. Jordan has secured an FSRU vessel that will be located offshore Aqaba, in the Red Sea, and the regasification terminal (0.5 Bcf/d capacity) is scheduled to come online in May 2015.

Uruguay is building infrastructure for an offshore regasification terminal (0.4 Bcf/d capacity) located near Montevideo to supply its domestic market and to potentially provide natural gas for export by pipeline to Argentina. Originally planned to come online in mid-2015, the regasification terminal has been delayed until 2016.

Four more floating regasification terminals totaling 1.3 Bcf/d are currently being developed in India, the Dominican Republic, Colombia, and the Philippines, with expected online dates in 2016-17.

Political Freedom

.jpg) In 2012, Höegh LNG entered into a ten year time charter with for an FSRU to be used as an LNG import terminal in Lithuania by Klaipedos Nafta. The FSRU Independence is capable of supplying 100 percent of Lithuania’s current demand for natural gas. It is a project that brings greater supply flexibility to a country that is currently dependent on gas pipelines from Russia.

In 2012, Höegh LNG entered into a ten year time charter with for an FSRU to be used as an LNG import terminal in Lithuania by Klaipedos Nafta. The FSRU Independence is capable of supplying 100 percent of Lithuania’s current demand for natural gas. It is a project that brings greater supply flexibility to a country that is currently dependent on gas pipelines from Russia.

Höegh LNG owns and operates a fleet of LNG carriers and FSRUs. The FSRUs can act as LNG carriers as well as floating LNG import terminals. This dual functionality means that when gas demand is low in summer time, Lithuania can save money by using the FSRU to retrieve its own cargo.