Farm-Fresh

(Article originally published in Nov/Dec 2016 edition.)

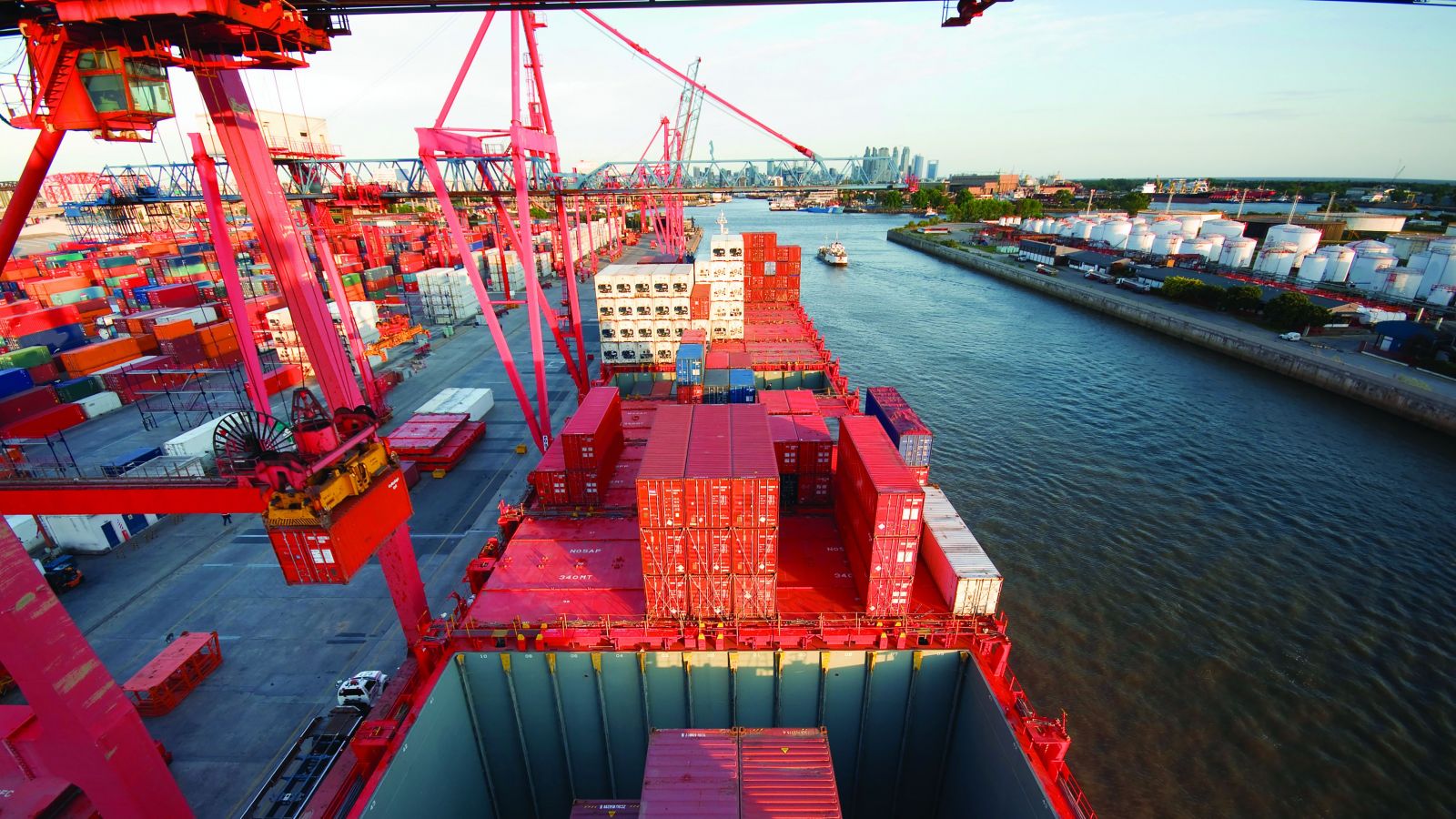

The global demand for perishables keeps growing.

By Tom Peters

The global cold supply chain is attracting a lot of attention these days from shippers, liner companies and cold-equipment manufacturers who are constantly looking to technology and new reefer systems to keep perishables longer and fresher during transit.

The attention is apparently warranted. Shipping consultancy Drewry has forecast 2.5 percent annual growth in reefer cargo through 2020 and expects global tonnage in the sector to reach 120 million annually. Research firm Technavio has set reefer growth even higher at four percent annually over the next four years.

And as the world’s need for food grows, so do shipments of traditional refrigerated cargoes like fresh fruits and vegetables, fish, meats and poultry. But the growth doesn’t stop there as companies involved in pharmaceuticals and floriculture are increasingly moving products in temperature-controlled containers.

As reefer cargoes ramp up, stakeholders respond.

Controlled-Atmosphere Systems

Osaka-based Daikin Industries, a global supplier of reefer containers, is moving forward in so-called controlled atmosphere systems (CA). “We believe the trend toward controlled atmosphere and away from precise temperature control will continue,” says President Shin Furuta. “Conventional passive CA relies on respiration, so you need to wait for the cargo to respirate to adjust the level of oxygen. Daikin’s Active CA device removes the need to wait for the cargo to respirate to adjust the level of oxygen. This achieves the CA set point in half the time of conventional passive CA, meaning it is now also viable for shorter voyages such as intra-Asia and other regional trades.”

Marseille-based shipping giant CMA CGM has developed AQUAVIVA, a new line of containers that employs a technology called INNOPURE, developed by the French firm EMYG Environment & Aquaculture. The containers have been designed to transport live lobsters. CMA CGM says test trials have delivered low mortality rates and high-quality product after several days at sea.

Port Expansions

Ports have been doing their part as well by attracting much-needed investment for new infrastructure to accommodate high-value reefer cargoes.

In August, the Port of Wilmington, North Carolina opened a $17.5 million, on-dock cold storage facility called Port of Wilmington Cold Storage. Paul Cozza, Executive Director of the North Carolina State Ports Authority, said the 103,000-square-foot facility with flash-freeze capability is a response to requests from importers and exporters for such a structure. Built in partnership with private investor USA InvestCo, the facility is served by both truck and rail and can handle a wide variety of products including poultry, sweet potatoes, seafood and fresh produce.

Wilmington anticipates continued reefer growth in 2017 as carriers such as Sea-Land plan to increased traffic through Wilmington with a focus on produce from Central and South America.

The Port of New Orleans has seen an “uptick” in its reefer business with increases in poultry and meat exports, says Matt Gresham, Director of External Affairs: “Through April of 2016, export poultry is up by 23 percent to 102,052 tons with the uptick a result of the easing of U.S. poultry sanctions by top export destinations like Korea. Those sanctions were tied to the avian flu fear in the U.S. poultry market.” Meat exports are up 30 percent through April to 17,559 tons compared to a year ago.

The port recently added to its reefer infrastructure with the completion of a $7.9 million, state-of-the-art refrigerated container racking system that can store over 600 refrigerated containers at one time.

The Port of Galveston has a long-time major tenant, Del Monte Fresh Produce Co., providing the majority of its refrigerated cargo, nearly 195,000 tons in the first nine months of 2016. Del Monte moves primarily bananas, pineapples and melons from Guatemala on a weekly service to Galveston. The company has a cold storage warehouse/distribution facility where the fruit is devanned and distributed to markets in 53-foot refrigerated trailer-trucks.

Although the port doesn’t have any major infrastructure projects on the drawing board right now, Captain John Peterlin III, Senior Director of Marketing and Administration, wants to expand the refrigerated cargo business: “We’ve very successful in the last 10 to 12 years in ro/ro, so we think where we need to concentrate more now is on refrigerated cargo. We are looking to see what opportunities there may be.”

However, finding the capital for infrastructure projects is a challenge. Galveston is an enterprise fund port and doesn’t have a tax base to raise bond funds and thereby procure the necessary capital for infrastructure improvements. As a result, “Everything we do has to come out of our operating revenues,” Peterlin explains. “It’s a big challenge.”

In nearby Houston there are several cold storage facilities to handle the growing volumes of refrigerated cargo. Typical perishable items moving over Houston’s terminals include fresh fruits, vegetables, pharmaceuticals, prepared foods and meats. The port is currently working with AGRO Merchants Group, a cold supply chain provider, to develop a new refrigerated storage facility to open in 2017 at the Bayport Container Terminal.

In September the port staged its first-ever “perishables roundtable,” an open forum designed to improve communication between all stakeholders within the perishables community. Participants included buyers and sellers, importers and exporters, retailers, brokers, cold storage operators, ocean carriers, truckers and public agencies involved in the trade.

Coast to Coast

At the Port of Jacksonville (JAXPORT), spokesman Frank Camp says the reefer business is expanding: “Poultry is still very strong for us along with inbound seafood, particularly from Asia.” He adds that the port will soon be busy with the export citrus season. JAXPORT is ready for growth with 30 million cubic feet of cold storage space in and around northeast Florida. Camp says there are some very large nationwide cold storage companies as well as some smaller firms located in the region.

Port Tampa Bay is making a move into the cold cargo sector and will have a new 130,000-square-foot ondock cold storage facility in operation by the summer of 2017, says Karl Strauch, Vice President for Business Development & Strategic Alliances. The new facility represents “phase one” of a longer, more complete food chain that will eventually transport perishable cargo to the Midwest, saving up to four days transit over the more common routes currently used.

The Port of San Diego has seen its reefer numbers increase with fruit and vegetable giant Dole boosting capacity with three new and bigger vessels to support its Latin American business. Joel Valenzuela, Director, Maritime Business Line, says the new vessels have gone from 500-550 FEUs (forty-foot equivalent units) to 770 FEUs each “and they are at capacity.” Dole has a 20-acre facility with reefer plugs at the port and also utilizes a 300,000-square-foot refrigerated warehouse.

Reefer products include bananas, pineapples, mangoes, meats, seafood, craft beer, and other types of perishables. The port is planning the redevelopment of its 10th Avenue Terminal, and some of that development will be aimed at boosting the cold cargo business, Valenzuela adds.

In the ports of Seattle and Tacoma, which together form the Northwest Seaport Alliance, temperature-controlled cargo is a growth area, says Sue Coffee, the Alliance’s Director of Business Development. In 2015 the two ports had a combined reefer container count of 202,784 TEUs (twenty foot equivalent units). The main exports include potatoes, fruits (with apples being a major crop), vegetables, cherries in summer, and poultry from the Midwest.

There are a number of cold storage facilities within close proximity of the two ports, operated by private companies such as Lineage Logistics, PCC Logistics and Washington Cold Storage. The Alliance stays close to these stakeholders, who handle product bound for major markets in Japan, Hong Kong and Korea. – MarEx

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.