Retailers’ Low Imports Signal Concerns for Container Lines and Ports

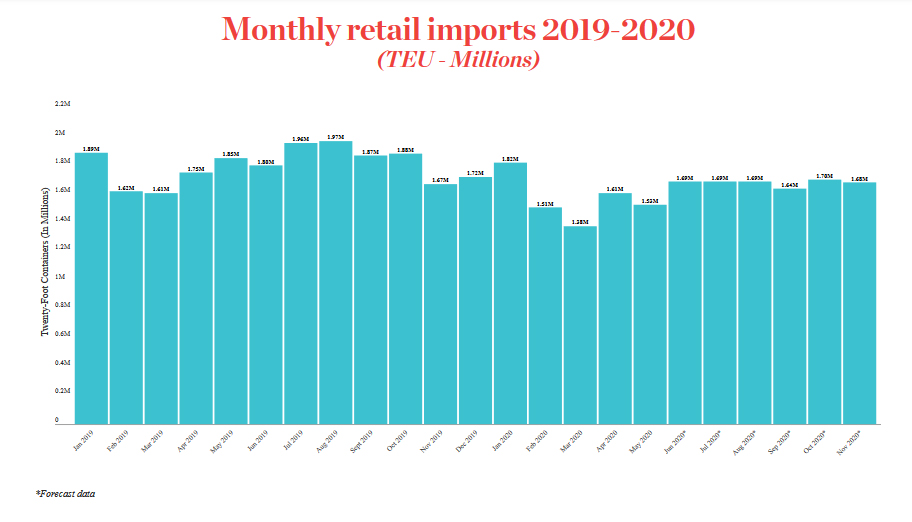

Adding to shippers and ports concerns are forecasts for continued weak consumer demand and a slower than expected holiday shopping season. Retail imports, while having recently improved slightly, are still far below last year, according to new data released by the National Retail Federation and Hacket Associates.

The retail trade association says in its new Global Port Tracker that retailers are expected to maintain a cautious stance preparing for the traditionally busy holiday selling season. As a result, import volumes at major U.S. container ports that handle retailers containers are expected to remain significantly below last year’s levels through the summer and into the fall of 2020.

“Economic indicators show that the recession brought on by the pandemic may be easing, but retailers are being conservative with the amount of merchandise they import this year,” NRF Vice President for Supply Chain and Customs Policy Jonathan Gold said. “The outlook for imports is slowly improving, but these are still some of the lowest numbers we’ve seen in years.”

According to the monthly report, container import volume at the major ports handling retailers’ traffic was down 4.8 percent in May versus the prior month. Total containers at the dozen major U.S. ports tracked by the report was just over 1.5 million TEUs in May 2020, which was down 17 percent year over year.

The forecast for the first half of 2020, according to the report, while down versus 2019, shows a slight improvement over prior projections for the first half of the year. They are now expecting a total of 9.5 million TEUs, down 9.3 percent from the same period last year, but improved from an earlier forecast for a 10 percent decline for the first six months of the year. The original forecast, before the onset of the pandemic, had called for 10.47 million TEUs for the first half of 2020.

“U.S. imports are performing like a yo-yo, up one month and down the next with no apparent cause that can realistically point to either a crashing or booming economy,” Hackett Associates Founder Ben Hackett said. “We’re starting to go out to eat and buy clothing again, but how sustainable is that? The danger is that the rising number of virus infections is leading to renewed restrictions, which may cause demand to weaken again.”

The outlook according to the report is relatively unchanged from a month ago with expectations for some months to be higher and some to be lower. Imports for the six months from May through October are expected to reach nearly 10 million TEUs, a slight improvement over the prior forecast. The individual months are expected to show increasing declines during the summer months with retailer container volume declining as much as 14 percent in July, which typically is the start of the retailers’ peak import period. Individual months are expected to remain just under 1.7 million TEUs per month with retailers' container volume usually trailing off in November and December after the bulk of holiday merchandise has arrived.

The Global Port Tracker, which is provided to NRF retail members or by subscription, tracks the largest U.S. container ports used by retailers for their imports. It includes Los Angeles/Long Beach, Oakland, Seattle and Tacoma on the West Coast; New York/New Jersey, Port of Virginia, Charleston, Savannah, Port Everglades, Miami and Jacksonville on the East Coast, and Houston on the Gulf Coast