World Waits for Iran Sanctions Deal

For nearly a week, the United States, Britain, France, Germany, Russia and China have been trying to break an impasse in talks with Iran over its nuclear research program. A deadline has been set for dawn on Wednesday.

The world powers have met in Switzerland, and they are trying to reach an agreement that could see sanctions eased. The six powers want more than a 10-year suspension of Iran's most sensitive nuclear work. Their goal is to find a way to ensure that for at least the next 10 years Iran is at least one year away from being able to produce enough fissile material for an atomic weapon.

The world powers have met in Switzerland, and they are trying to reach an agreement that could see sanctions eased. The six powers want more than a 10-year suspension of Iran's most sensitive nuclear work. Their goal is to find a way to ensure that for at least the next 10 years Iran is at least one year away from being able to produce enough fissile material for an atomic weapon.

Sanctions have halved Iran’s oil exports to just over one million barrels per day since 2012, and this has hammered its economy.

Shipping rates could improve

Shipping rates for crude would double if Iran is freed from sanctions and manages to increase exports by as much as the nation’s oil ministry predicts, reports Morgan Stanley. And, according to Bloomberg, the industry’s biggest tankers could earn as much as $100,000 a day should Iran boost exports by one million barrels a day.

Iran is storing at least 30 million barrels of oil on a fleet of supertankers, most belonging to its national carrier NITC. An estimated 15 NITC's VLCCs, each capable of carrying two million barrels of oil, have been deployed off the Iranian coast as floating storage.

Oil prices dropping

Higher Iranian oil exports are likely to put more pressure on weak global oil prices.

Brent crude prices dropped on Tuesday as negotiations continued, reports Petro Global News. Brent crude fell to $55.60 per barrel on Monday, a 1.4 percent drop from Friday, while U.S. crude slid almost one percent to $48.43 per barrel. Investors are concerned that a nuclear deal could flood already swollen crude inventories with even more oil, said the news agency.

The Swiss talks come just as Saudi Arabia has announced that it will not curb production to stabilize global prices, instead calling on non-OPEC producers to implement cuts before OPEC members will consider it.

OPEC production accounts for around 30 percent of the global market. In the past, Saudi Arabia often played the role of the swing producer, temporarily cutting its production to offset supply growth elsewhere or weaker global demand, or increasing its output level to make up for a supply shortfall.

OPEC earnings could bounce back

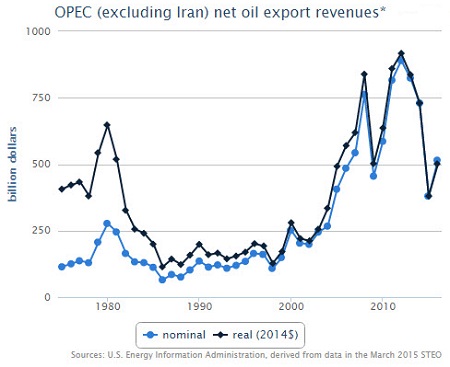

For 2014, the U.S. Energy Information Administration (EIA) estimates that, excluding Iran, OPEC members earned about $730 billion in net oil export revenues (unadjusted for inflation). This represents an 11 percent decline from the $824 billion earned in 2013, largely because of the decline in average annual crude oil prices, and to a lesser extent from decreases in the amount of OPEC net oil exports. This was the lowest earnings for the group since 2010.

These net export earnings do not include Iran's revenues because of the difficulties associated with estimating Iran's earnings, including the country's inability to receive payments and possible price discounts Iran offers its existing customers.

These net export earnings do not include Iran's revenues because of the difficulties associated with estimating Iran's earnings, including the country's inability to receive payments and possible price discounts Iran offers its existing customers.

Saudi Arabia earned the largest share of these earnings, $246 billion in 2014, representing approximately one-third of total OPEC oil revenues.

For 2015, EIA projects that OPEC net oil export revenues (excluding Iran) could fall further to about $380 billion in 2015 (unadjusted for inflation) as a result of the much lower annual crude oil prices expected in 2015. EIA expects that OPEC's crude oil production and exports in 2015 will be unchanged from 2014 levels, following OPEC's decision on November 27 to not change its production targets from previous levels.

On a per capita basis, OPEC (excluding Iran) net oil export earnings are expected to decline by half from about $2,186 in 2014 to $1,114 in 2015. For 2016, OPEC revenues are projected to rebound to $515 billion with the expected rebound in crude oil prices.