BIMCO: The Shipping Market in 2014 & Looking Forward

Global Economy: Fragile recovery highlights the need for more political initiatives

2014 started with plenty of optimism for a considerably better global economy and an improved shipping market. Things turned out somewhat differently. Adverse weather conditions in the US during winter were the dominant factor, creating a difficult first half of the year for the global economy. The developing and emerging markets continued on a downward trend, while a sunnier outlook from the US and Europe had the effect of moving the already more advanced economies forward.

The quantitative easing program of the US Central Bank has now ended. This is a landmark in terms of recovery. Following a quadrupling of the US monetary base, unemployment has come down, the stock market has gone up and economic growth has become more robust. The UK has followed the same path as the US, with similar results. This is outstanding in the otherwise sluggish European economic development.

In Japan, “Abenomics” is facing headwinds caused by a hike in sales taxes and a subsequent return to recession. Japan’s economy has been stagnating for decades, and it is unlikely to move much further forward from this in 2015.

The slowing of the Chinese economy is adding uncertainty to the level of shipping demand generated in the Far East. Its soft landing seems to incur turbulence, with some indicators suggesting the official GDP data may not give us the full story.

Growth in emerging markets and developing economies is set for a comeback in 2015, with GDP-growth improving from 4.4% in 2014 to 5.0% in 2015. The advanced economies are likely to stay on the recovery track, and improve their GDP-growth to 2.3% in 2015 (1.8% in 2014). The common challenges remain poor inflation expectations, a lack of structural reforms and lack of job creation. There is clearly room for more political initiatives in 2015 to support the global economy.

Supply: A stalling orderbook means reality has hit home

The total orderbook remained unchanged during 2014. This signals that the industry is now realizing that more new orders may not be the right thing to do after all.

The fundamental oversupply of capacity in all of the major shipping segments has not changed much over the past year. A higher level of demand has only just matched the net supply of new tonnage coming on stream.

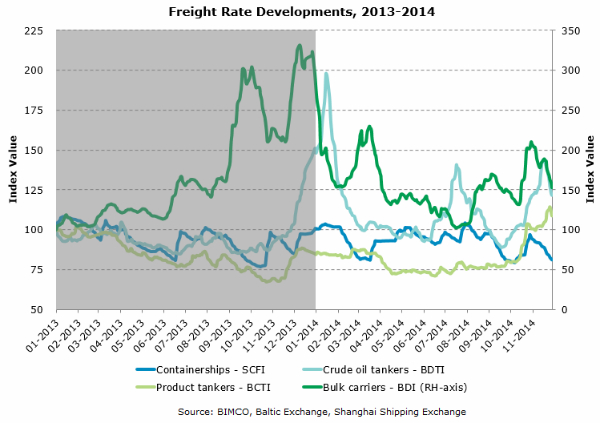

Crude oil tankers are the only exception to the general status quo in the balance of freight markets. A multi-year low inflow of new crude oil tankers has stimulated earnings growth of some 20% compared to 2013. Meanwhile, the growing supply pressure in product tankers neutralized most of the growing demand side, with earnings coming in just a little shy of 2013.

Container ships keep getting bigger, breaking previous size records for both individual ships and the average size across the fleet. The CSCL Globe, with a capacity of 19,000 TEU, was launched in November, and the average TEU capacity of a 2014-newbuild increased to 7,400 TEU, up from 6,600 TEU in 2013. Next year the scheduled average is 8,000 TEU.

Looking forward to 2015, BIMCO expects the dry bulk fleet to have found a new “normal” level of supply side growth, expanding by 5.1% (5.5% in 2014). Regrettably, the level is still too high to reduce the glut of ships in the market. For tankers, BIMCO expects the dirty segment to grow by 1.7% (1.3% in 2014). Three years of low supply growth has led to more positive short-term prospects for crude oil tankers. In the clean segment, the estimated supply growth for 2015 is 4.6% (4.3% in 2014). Supply growth in the container ship segment is expected to drop to 5.8% in 2015 (6.2% in 2014).

Dry Bulk: New challenges await as demand slows down

BIMCO expects dry bulk demand to slow in 2015 to a rate of 4-5%. Iron ore demand will again be the center of attention. In recent years, demand growth has been biased heavily towards the Capesize segment. In 2014, 70% of the total volume growth came from increased iron ore demand driven by China. BIMCO expects this trend to continue, with Capesizes outperforming the smaller sizes relatively.

The strong iron ore demand in 2014 was somewhat neutralized by weaker coal demand from China. Meanwhile, the Indonesian ban on exports of unprocessed bauxite and nickel ore resulted in a weak Supramax market in the Far East.

Towards the end of the year, the late arrival of strong exports of iron ore out of Brazil proved to be insufficient to deliver on the promise of 2013, when rates for all segments went up. While earnings had hit the floor in 2012, BIMCO expected 2014 to build on the optimism of 2013 and continue on the road to recovery. That did not materialize.

Tanker: what is the “new normal” demand level?

The crude oil tanker market started 2014 on a very positive note, with a five-year-high for earnings in the first quarter. The market’s strength showed clearly in early autumn and in the current winter market. The export of crude oil from West Africa has shifted from West to East as the US has reduced its imports to almost zero. This has given the demand side momentum, as West Africa now export more to the Far East, creating many more ton-miles.

For product tankers, the final quarter of 2014 contrasts greatly with the dull and flat market we have seen for most of the year. Despite US oil product export growth slowing down, it remains a positive story overall. Demand growth just managed to match supply growth, as the positive events arrived late in the year for the shipping market as well as in global economics.

Falling oil prices stirred some positive unrest in the tanker market, with rising tonnage demand in their wake. In spite of the price drop arising from weak oil demand and oversupply in the market, the current low and volatile commodity price is good for trading and shipping.

With a dramatic fall in bunker prices, it is vital for a continued industry recovery that all shipping segments resist higher speeds. Failure to do so may compromise improvement of the fundamental balance, which is essential to bring prosperity back.

Container: Will strong demand and slow steaming remain?

Strong demand growth on the large-volume trades from Far East to US and Europe has brought lower volatility in freight rates on key trades while re-activating most of the previously idle ships.

However, during peak season, the steep drop in freight rates on the Far East to Europe trade lane made it clear that the utmost care is constantly required for the supply side, while the introduction of ever-larger ships continues.

Improved industry earnings currently rest on one central requirement: slow steaming and defense of individual market share. This highly competitive market only returns a positive margin if the cost base is extremely low.

BIMCO expects containership supply to continue to grow at its “new normal” level of around 6%, making the demand side a focal point. European demand has been stronger than private consumption figures indicated, and we may well see further improvement for US demand. The US East Coast could build further on a remarkable year as the ports prepare for the imminent arrival of ultra-large container ships. Enlargement projects in the Panama Canal and Suez Canal will further influence the deployment of ships.