New Life for Iran's Oil Industry

Iran's oil production has declined substantially over the past few years. International sanctions have stymied progress across Iran's energy sector, especially affecting upstream investment in both oil and natural gas projects. The United States and the EU enacted measures at the end of 2011 and during the summer of 2012 that have affected the Iranian energy sector more profoundly than any previously enacted sanctions. The sanctions impeded Iran's ability to sell oil, resulting in a 1.0-million bbl/d drop in crude oil and condensate exports in 2012 compared with the previous year.

According to the International Monetary Fund (IMF), Iran's oil and natural gas export revenue was $118 billion in the 2011/2012 fiscal year (ending March 20, 2012). In the 2012/2013 fiscal year, oil and natural gas export revenue dropped by 47 percent to $63 billion.

On November 24, 2013, a Joint Plan of Action (JPOA) was established between Iran and the five permanent members of the United Nations Security Council (the United States, United Kingdom, France, Russia, and China) plus Germany (P5+1). Implementation of the JPOA started in January 2014. Under the JPOA, Iran agreed to scale back or freeze some of its nuclear activities during the six months of negotiations in exchange for some sanctions relief. The period of negotiations was recently extended for another four months to November 24. The JPOA aims to reach a long-term comprehensive plan that ensures that Iran's nuclear program is peaceful, which may lead to the lifting of international sanctions.

The JPOA does not directly allow for additional Iranian oil sales, although it does suspend sanctions on associated insurance and transportation services. However, Iran and the countries that are continuing to import Iranian oil have increasingly been able to find alternatives to European Protection and Indemnity Clubs (P&I) coverage from EU companies.

The JPOA does not directly allow for additional Iranian oil sales, although it does suspend sanctions on associated insurance and transportation services. However, Iran and the countries that are continuing to import Iranian oil have increasingly been able to find alternatives to European Protection and Indemnity Clubs (P&I) coverage from EU companies.

Iran's crude oil and condensate exports increased in late 2013 and have maintained a level above the 2013 average. From January to May 2014, Iran's crude oil and condensate exports averaged 1.4 million bbl/d, roughly 300,000 bbl/d higher than the 2013 average, according to the International Energy Agency (IEA). Exports to China and India account for almost all of the increase.

Foreign investment

Iran is planning to change the oil contract model to allow independent oil companies (IOCs) to participate in all phases of an upstream project, including production. However, international sanctions continue to affect foreign investment in Iran's energy sector, limiting the technology and expertise needed to expand the capacity at oil and natural gas fields and reverse production declines.

The Iranian constitution prohibits foreign or private ownership of natural resources, and all production-sharing agreements (PSAs) are prohibited under Iranian law. The government permits buyback contracts that allow IOCs to enter into exploration and development contracts through an Iranian subsidiary. The buyback contract is similar to a service contract and requires the contractor (or IOC) to invest its own capital and expertise for development of oil and natural gas fields.

After the field is developed and production has started, the project's operatorship reverts back to the NIOC or the relevant subsidiary. The IOC does not get equity rights to the oil and gas fields. The NIOC uses oil and gas sales revenue to pay the IOC back for the capital costs. The annual repayment rates to the IOC are based on a predetermined percentage of the field's production and rate of return, according to a report by Clyde and Company. According to FACTS Global Energy (FGE), the rate of return on buyback contracts varies between 12 percent and 17 percent with a payback period of about five to seven years.

Iran recently announced a new oil contract model called the Iranian (or Integrated) Petroleum Contract (IPC), although it is not yet finalized and is subject to change. The purpose of the new framework is to attract foreign investment with a contract that contains terms similar to a PSA. Some of the main criticisms of the buyback contracts include lack of flexibility of cost recovery and in some cases, the NIOC's limited expertise to reverse field decline rates in comparison to the IOC that developed the field.

Under the current draft IPC, IOCs can establish a joint venture agreement with the NIOC or a relevant subsidiary to manage oil and natural gas exploration, development, and production projects. IOCs will help manage the projects, but they will not have ownership of the reserves. IOCs will be paid a share of the project's revenue in installments once production starts. The payment terms can be adjusted as the project progresses, according to the Middle East Economic Survey (MEES).

IPCs will cover a longer time period of between 20 to 25 years, which is double the amount of time under the buyback contract. The IPC will encompass the exploration, development, and production phases, along with the possibility to extend into enhanced oil recovery (EOR) phases. This proposed contract model is different from the current buyback contracts, which only cover the exploration and development phases. This modification aims to rectify issues with field decline rates by including the IOC in the production and recovery phases, while optimizing technology and knowledge transfers. To help facilitate knowledge and technology transfers, the IPC will require IOCs to fulfill Iran's local content requirement, which will be 51 percent of the contract.

International sanctions have affected Iran's energy sector by limiting the foreign investment, so the country has mainly had to depend on local companies to develop oil fields. Chinese and Russian companies are the only IOCs currently directly or indirectly involved with developing oil fields, according to FGE.

Reserves

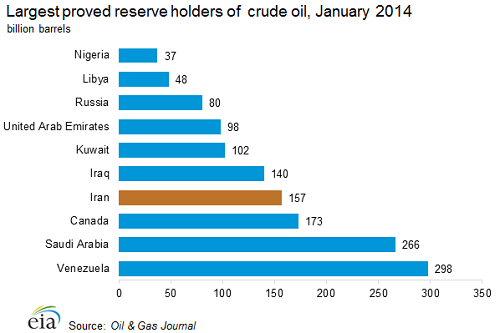

Iran holds nearly 10 percent of the world's crude oil reserves and 13 percent of OPEC reserves. About 70 percent of Iran's crude oil reserves are located onshore, with the remainder mostly located offshore in the Persian Gulf. Iran also holds proved reserves in the Caspian Sea.

According to the Oil & Gas Journal, as of January 2014, Iran has an estimated 157 billion barrels of proved crude oil reserves. Most of Iran's reserves were discovered decades ago. Iran has proved and probable oil reserves of approximately 500 million barrels mostly offshore in the Caspian Sea, but exploration and development of these reserves have been at a standstill because of territorial disputes with neighboring Azerbaijan and Turkmenistan. Iran also shares a number of both onshore and offshore fields with neighboring countries, including Iraq, Qatar, Kuwait, and Saudi Arabia.

Exploration and production

Iran's crude oil production fell dramatically in 2012, following the implementation of sanctions in late-2011 and mid-2012. Iran dropped from being the second-largest crude oil producer in OPEC to the fourth in 2013, after Saudi Arabia, Iraq, and narrowly behind the United Arab Emirates (UAE). Iran's production increased in 2014, increasing Iran's rank to the third-largest crude oil producer in OPEC during the first half of 2014.

Iran is one of the founding members of OPEC, which was established in 1960. Since the 1970s, Iran's oil production has varied greatly. Iran averaged production of over 5.5 million bbl/d of oil in 1976 and 1977, with production topping 6.0 million bbl/d for much of the period. Since the 1979 revolution, however, a combination of war, limited investment, sanctions, and a high rate of natural decline of Iran's mature oil fields has prevented a return to such production levels.

Crude oil and condensate exports

The largest buyers of Iranian crude and condensate are China, India, Japan, South Korea, and Turkey. Iran's exports increased in the beginning of 2014. From January to May 2014, Iran's exports averaged 1.4 million bbl/d, 300,000 bbl/d higher than the 2013 annual average, according to the IEA. China and India accounted for nearly all of that increase.