Mexico Boosts Exploration as Oil Production Falls

Mexico is one of the 10 largest oil producers in the world, the third-largest in the Americas after the United States and Canada, and an important partner in the U.S. energy trade. However, Mexico's oil production has steadily decreased since 2005 as a result of natural production declines from Cantarell and other large offshore fields. In December 2013, in an effort to address the declines of its domestic oil production, the Mexican government enacted constitutional reforms that ended the 75-year monopoly of Petroleós Mexicanos (PEMEX), the state-owned oil company.

Oil is a crucial component of Mexico's economy. The oil sector generated 13 per cent of the country's export earnings in 2013, a proportion that has declined over the past decade, according to Mexico's central bank. More significantly, earnings from the oil industry (including taxes and direct payments from PEMEX) accounted for about 32 per cent of total government revenues in 2013. Declines in oil production have a direct impact on the country's economic output and on the government's fiscal health, particularly as refined product consumption and import needs grow.

Oil is a crucial component of Mexico's economy. The oil sector generated 13 per cent of the country's export earnings in 2013, a proportion that has declined over the past decade, according to Mexico's central bank. More significantly, earnings from the oil industry (including taxes and direct payments from PEMEX) accounted for about 32 per cent of total government revenues in 2013. Declines in oil production have a direct impact on the country's economic output and on the government's fiscal health, particularly as refined product consumption and import needs grow.

Mexican authorities report that the country exported 1.19 million bbl/d of crude oil in 2013, a decline that has occurred since 2010. The United States received approximately 71 per cent of Mexico's oil exports, which arrived by tanker. Most Mexican crude oil exports to the United States are Maya blend, while Mexico retains most of the output from its lighter crude streams—Isthmus and Olmeca—for domestic consumption. The United States will continue to attract the bulk of Mexico's oil exports because of the proximity and the operation of sophisticated U.S Gulf Coast refineries capable of processing heavier Maya crudes.

Mexico is typically among the top three exporters of oil to the United States. In 2013, the United States imported 850,000 bbl/d of crude oil from Mexico, behind Canada and Saudi Arabia.

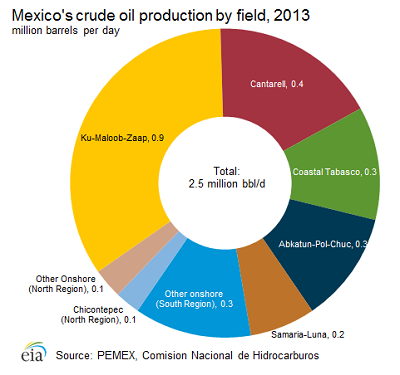

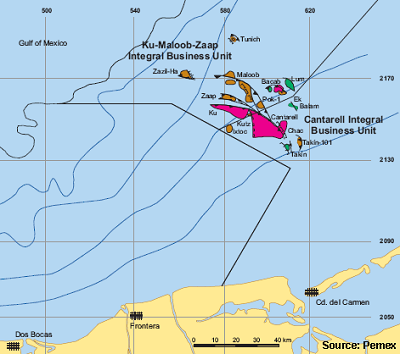

Most of Mexico's oil production occurs off the eastern coast in the Bay of Campeche of the Gulf of Mexico, near the states of Veracruz, Tabasco, and Campeche. The two main production centers in the area are Cantarell and Ku-Maloob-Zaap (KMZ). In total, approximately 1.9 million bbl/d — or three-quarters — of Mexico's crude oil is produced offshore in the Bay of Campeche.

Most of Mexico's oil production occurs off the eastern coast in the Bay of Campeche of the Gulf of Mexico, near the states of Veracruz, Tabasco, and Campeche. The two main production centers in the area are Cantarell and Ku-Maloob-Zaap (KMZ). In total, approximately 1.9 million bbl/d — or three-quarters — of Mexico's crude oil is produced offshore in the Bay of Campeche.

Cantarell was once one of the largest oil fields in the world, but its output has been declining significantly for almost a decade. Production at Cantarell began in 1979, but stagnated as a result of falling reservoir pressure. In 1997, PEMEX developed a plan to reverse the field's decline by injecting nitrogen into the reservoir to maintain pressure, which was successful for a few years. However, production resumed a rapid decline beginning in the middle of the last decade—initially at extremely rapid rates, and more gradually in recent years. In 2013, Cantarell produced 440,000 bbl/d of crude oil, which was nearly 80 per cent below the peak production level of 2.1 million bbl/d reached in 2004. As production at the field has declined, so has its relative contribution to Mexico's oil sector. Cantarell accounted for 17 per cent of Mexico's total crude oil production in 2013, compared with 63 per cent in 2004.

Meanwhile, KMZ, which is adjacent to Cantarell, has emerged as Mexico's most prolific field. Production nearly tripled between 2004 and 2013, when it reached 864,000 bbl/d, as PEMEX used a nitrogen reinjection program similar to that used at Cantarell. PEMEX hopes to increase output further over the next few years, in part through the development of the anticipated 100,000-bbl/d Ayatsil satellite field, although views differ about whether the KMZ complex has already reached peak production.

Mexico's other offshore oil production center is to the southwest in the Bay of Campeche, near the state of Tabasco. There the Abkatun-Pol-Chuc and Litoral de Tabasco projects, each consisting of several small fields, accounted for a combined 593,000 bbl/d of oil production in 2013. The production trajectories of the two field complexes differ considerably. Output from Litoral de Tabasco has increased from less than 200,000 bbl/d in 2008 to nearly 300,000 bbl/d in 2013, offsetting some of the declines at Cantarell. Litoral de Tabasco also includes the promising Tsimin and Xux discoveries. Production from Abkatun-Pol-Chuc, on the other hand, has declined considerably from peak levels achieved in the mid-1990s, when output exceeded 700,000 bbl/d; production in 2013 was under 300,000 bbl/d.

Mexico's other offshore oil production center is to the southwest in the Bay of Campeche, near the state of Tabasco. There the Abkatun-Pol-Chuc and Litoral de Tabasco projects, each consisting of several small fields, accounted for a combined 593,000 bbl/d of oil production in 2013. The production trajectories of the two field complexes differ considerably. Output from Litoral de Tabasco has increased from less than 200,000 bbl/d in 2008 to nearly 300,000 bbl/d in 2013, offsetting some of the declines at Cantarell. Litoral de Tabasco also includes the promising Tsimin and Xux discoveries. Production from Abkatun-Pol-Chuc, on the other hand, has declined considerably from peak levels achieved in the mid-1990s, when output exceeded 700,000 bbl/d; production in 2013 was under 300,000 bbl/d.

According to the Oil & Gas Journal (OGJ), Mexico had 10 billion barrels of proved oil reserves as of the end of 2013. Most reserves consist of heavy crude oil varieties, with the largest concentration occurring offshore of the southern part of the country, particularly the Campeche Basin. There are also sizable reserves in onshore basins in the northern parts of the country.

Mexico is believed to possess considerable hydrocarbon resources in the deepwater Gulf of Mexico that have not yet been developed. PEMEX has been drilling deepwater exploratory wells since 2006, making its first significant find in the Perdido Fold Belt, near the U.S. maritime border, in August 2012. In February 2012, the United States and Mexico signed a Transboundary Hydrocarbon Agreement concerning the development of oil and gas reservoirs that extend across their maritime border. The agreement established a cooperative process and legal framework for safely managing and jointly utilizing transboundary reserves, and ends the current moratorium on exploration and production in the transboundary area. Furthermore, in March 2014, as part of the newly-enacted energy reforms, PEMEX submitted its request to maintain and develop those fields in the Perdido Fold before Mexico opens undeveloped fields to international investors.