Indonesia?s Share of LNG Supply Declines

The U.S. Energy Information Administration says that after accounting for more than one third of global LNG exports throughout the 1990s, Indonesia's share of the global market is currently about 7 per cent.

This declining share is a result of both growing global LNG demand that is increasingly served by non-Indonesian supply and lower Indonesian exports. While Indonesia's LNG exports have fallen by 40 per cent since 1999, driven by the country's economic growth that has stimulated higher levels of domestic energy consumption, global LNG demand has risen over 150 per cent during the same period.

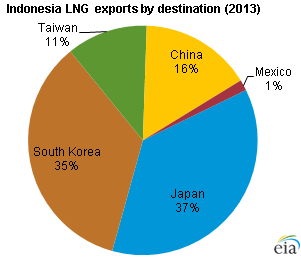

Until 2006, when its share was overtaken by exports from Qatar, Indonesia was the largest LNG exporter in the world. Indonesia is now the fourth-largest exporter of LNG after Qatar, Malaysia, and Australia, according to EIA estimates. Indonesia exported nearly all of its LNG to South Korea, Japan, China, and Taiwan, with much smaller volumes to Mexico and a few other nations. In 2013, Indonesia exported approximately 818 Bcf of LNG.

Until 2006, when its share was overtaken by exports from Qatar, Indonesia was the largest LNG exporter in the world. Indonesia is now the fourth-largest exporter of LNG after Qatar, Malaysia, and Australia, according to EIA estimates. Indonesia exported nearly all of its LNG to South Korea, Japan, China, and Taiwan, with much smaller volumes to Mexico and a few other nations. In 2013, Indonesia exported approximately 818 Bcf of LNG.

LNG exports are politically sensitive in Indonesia because of increased domestic demand for energy. Expected growth in natural gas demand led the government to pursue policies securing domestic supplies for the local market. To meet the natural gas domestic market obligation (DMO), LNG producers must designate 25 per cent of supply for the domestic market.

Indonesia currently has three liquefaction plants, Arun, Bontang, and Tangguh, on the islands of Sumatra, Kalimantan, and Papua, respectively. IHS Global Insight estimates current total liquefaction capacity at roughly 1.5 trillion cubic feet (Tcf) per year. Two new liquefaction plants, Donggi-Senoro and Sengkang, are under construction in Sulawesi. The Donggi-Senoro LNG plants received government approval only after the developers designated 30 per cent of the output explicitly for domestic consumption, exceeding the DMO floor of 25 per cent.

As part of its efforts to meet domestic demand, Indonesia is planning additions to its regasification capacity. PT Pertamina (the country's state-owned energy supply company) plans to convert the Arun LNG plant into a regasification terminal to serve the domestic market. IHS Global Insight expects the converted Arun plant to come online by late 2014 with a capacity of roughly 146 Bcf per year. In addition, Pertamina and PLN (Indonesia's state electricity firm) plan to develop eight small LNG receiving terminals in the eastern regions of the country by 2015, with a total capacity of 67 Bcf per year. The government intends for these facilities to supply domestic electricity plants.